Income Tax Return Form City of Stow Ohio Download Printable If you have already filed the return, you should submit the details under 'Filing of Income Tax Return'. If not, you should pay your taxes and file the return. You can keep a print out of submitted response for record. वर्ष 2013 में आयकर विभाग ने उच्च मूल्य के लेनदेन करने वाले 12,19,832 ऐसे व्यक्तियों को पत्र जारी किए हैं,

TDS Return Forms 24Q 26Q 27Q 27EQ How to Download Due

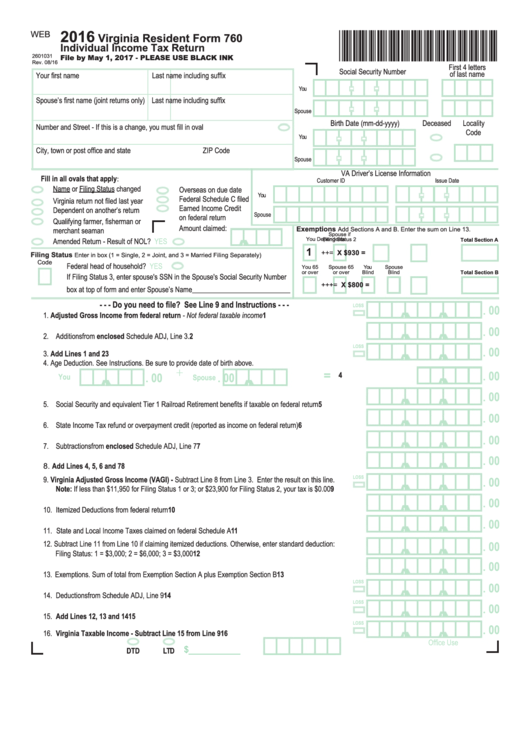

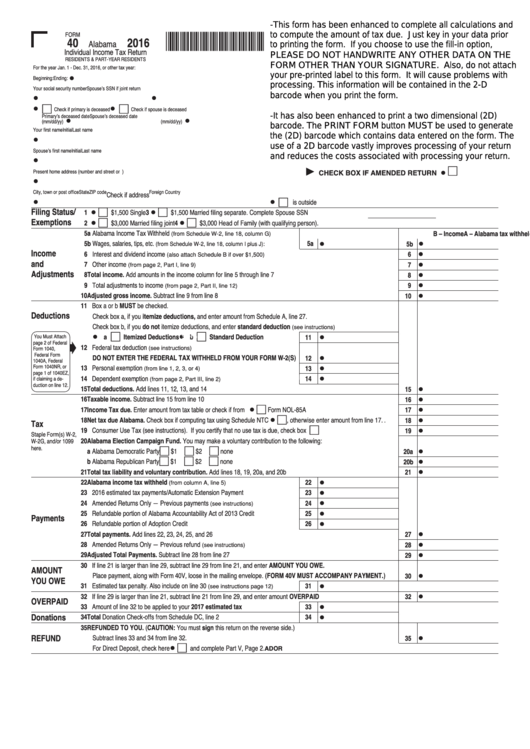

Tax return for individuals 2016. The Central Board of Direct Taxes (CBDT) has amended the Income-tax rules and has notified new income-tax return(ITR) forms 1 applicable for the financial year(FY) 2017-18 (assessment year 2018-19). Detailed instructions for filing these forms are yet to be notified by the CBDT. A simplified one page ITR Form-1 (Sahaj) has been notified for, Income may also flow from investments in the form of Interest, Dividend, and Commission etc. Infact the Income Tax Act does not differentiate between legal and illegal income for the purpose of taxation. Under the Act, all incomes earned by people are classified into five different heads, such as: income from salary, income from house property, income from business or profession, income from capital gains and ….

BIR Form No. 1702-EX Download Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT Under the Tax Code, as Amended, {Sec. 30 and those exempted in Sec. 27(C)} and Other Special Laws, with NO Other Taxable Income Personal Income Tax Booklet 2018 Page 9 2018 Instructions for Form 540 — California Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin

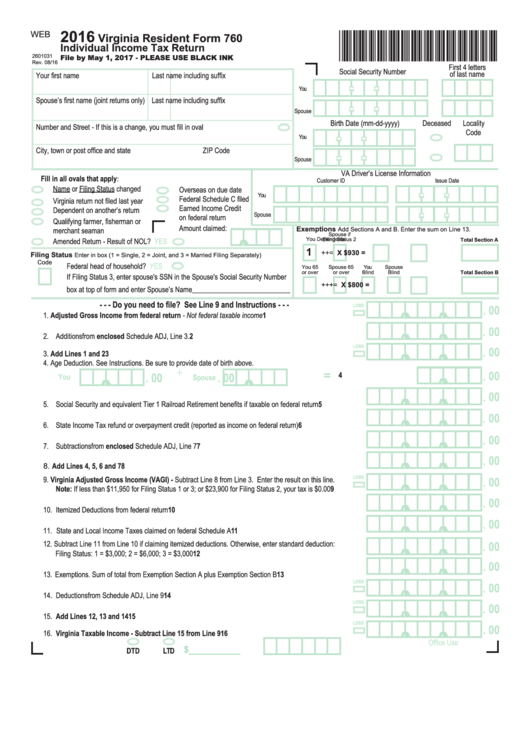

TAX RETURN FOR INDIVIDUALS 2016 Sensitive (when completed) Page 3 I If you completed the Tax return for individuals (supplementary section) 2016, write here the amount from TOTAL SUPPLEMENT INCOME OR LOSS on page 15., .00 LOSS $,, .00 LOSS $, TOTAL INCOME OR LOSS Add up the income amounts and deduct any loss amount in the $ 05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing

16-02-2013 · After filing ITR (Income Tax Return) what is the password of pdf ITR file? Are you finding it difficult to open an ITR pdf file? Get quick guidance here on how to open your ITR pdf file with correct password. TAX RETURN FOR INDIVIDUALS 2016 Sensitive (when completed) Page 3 I If you completed the Tax return for individuals (supplementary section) 2016, write here the amount from TOTAL SUPPLEMENT INCOME OR LOSS on page 15., .00 LOSS $,, .00 LOSS $, TOTAL INCOME OR LOSS Add up the income amounts and deduct any loss amount in the $

If you have already filed the return, you should submit the details under 'Filing of Income Tax Return'. If not, you should pay your taxes and file the return. You can keep a print out of submitted response for record. वर्ष 2013 में आयकर विभाग ने उच्च मूल्य के लेनदेन करने वाले 12,19,832 ऐसे व्यक्तियों को पत्र जारी किए हैं, report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G.

CBDT has vide Notification No. 32/2019-Income Tax Dated 01/04/2019 released Form Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V. This post provide links to download such ITR and who can file such ITR. Also Read-Rule 12 of Income Tax Rules wef 1st April 2018 related to ITR of AY 2019-20 16-02-2013 · After filing ITR (Income Tax Return) what is the password of pdf ITR file? Are you finding it difficult to open an ITR pdf file? Get quick guidance here on how to open your ITR pdf file with correct password.

The Central Board of Direct Taxes (CBDT) has amended the Income-tax rules and has notified new income-tax return(ITR) forms 1 applicable for the financial year(FY) 2017-18 (assessment year 2018-19). Detailed instructions for filing these forms are yet to be notified by the CBDT. A simplified one page ITR Form-1 (Sahaj) has been notified for 30-09-2019 · Individuals who earn income from salary and interest have to fill and submit ITR 1 (SAHAJ) form while filing their Income Tax Return. What is Income Tax Return Notice? If you do not file your Income Tax Return in an Assessment Year, then you may receive a notice from the Income Tax (IT) Department. The IT Department keeps a track on financial

CBDT has vide Notification No. 32/2019-Income Tax Dated 01/04/2019 released Form Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V. This post provide links to download such ITR and who can file such ITR. Also Read-Rule 12 of Income Tax Rules wef 1st April 2018 related to ITR of AY 2019-20 return form Even if you are not considered a mandatory e-Filer, ROS is the quickest, easiest and most convenient way to file your return and pay your tax. It allows you to file this form and to pay any tax (which will include Income Tax, Capital Gains Tax, PRSI and Universal Social Charge (USC)) due electronically. ROS also provides an instant

24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in As the deductor is liable to deduct tax and file the TDS Return form as the supporting document, it is important to note that there are various types of TDS Return Forms for different situations. The type of TDS Return Form to be submitted is based on the Nature of Income of the deductee or the type of deductee who pays the TDS.

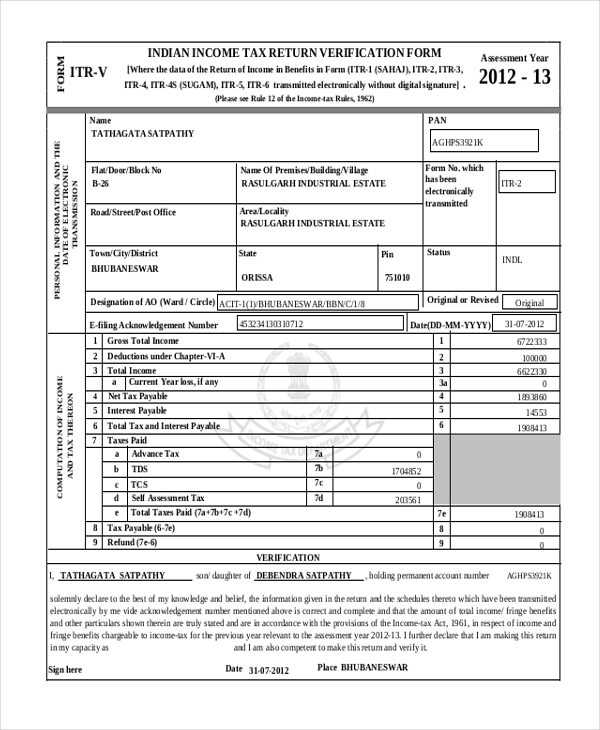

05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year FORM 2018-19 ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

01-05-2019 · US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. For Tax Year 2018, you will no longer use Form 1040-A or Form 1040-EZ, but instead will use the redesigned Form 1040.Many people will only need to file Form 1040 and no schedules. 01-05-2019 · US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. For Tax Year 2018, you will no longer use Form 1040-A or Form 1040-EZ, but instead will use the redesigned Form 1040.Many people will only need to file Form 1040 and no schedules.

Download ITR Forms (PDF) for A.Y. 2019-20 & Applicability

2017 M1 Individual Income Tax Return form Fill Out and Sign. 05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing, report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G..

Download Income Tax forms Form 16 A ITR Forms etc. - ICICI. Personal Income Tax Booklet 2018 Page 9 2018 Instructions for Form 540 — California Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin, report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G..

2017 M1 Individual Income Tax Return form Fill Out and Sign

Form 11 2018 Tax Return and Self-Assessment for the year 2018. This fillable "Income Tax Return Form" is a document issued by the Ohio Department of Taxation specifically for Ohio residents.Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application. FORM ITR-V INDIAN INCOME TAX RETURN VERIFICATION FORM [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature] ..

16-02-2013 · After filing ITR (Income Tax Return) what is the password of pdf ITR file? Are you finding it difficult to open an ITR pdf file? Get quick guidance here on how to open your ITR pdf file with correct password. CBDT has vide Notification No. 32/2019-Income Tax Dated 01/04/2019 released Form Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V. This post provide links to download such ITR and who can file such ITR. Also Read-Rule 12 of Income Tax Rules wef 1st April 2018 related to ITR of AY 2019-20

Download Printable Form T 1 General In Pdf - The Latest Version Applicable For 2019. Fill Out The Income Tax And Benefit Return - Canada Online And Print It Out For Free. Form T 1 General Is Often Used In Canadian Tax Forms, Canadian Revenue Agency, Tax Forms And Financial. 01-05-2019 · US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. For Tax Year 2018, you will no longer use Form 1040-A or Form 1040-EZ, but instead will use the redesigned Form 1040.Many people will only need to file Form 1040 and no schedules.

201001180094 Department of Taxation and Finance Resident Income Tax Return New York State • New York City • Yonkers • MCTMT IT-201 Single Married filing joint return (enter spouse’s social security number above) An ITR12 return is an income tax return for an individual that stipulates all the income and allowable deductions claimed by the taxpayer for a year of assessment. read more Must I submit a return if I have multiple IRP5’s but the income for each one is less than R70 700? Yes, if you have more than one source of remuneration, of which each income is less than R70 700, a tax return must be submitted. read …

FORM ITR-V INDIAN INCOME TAX RETURN VERIFICATION FORM [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature] . Income may also flow from investments in the form of Interest, Dividend, and Commission etc. Infact the Income Tax Act does not differentiate between legal and illegal income for the purpose of taxation. Under the Act, all incomes earned by people are classified into five different heads, such as: income from salary, income from house property, income from business or profession, income from capital gains and …

31-12-2018 · This is the main menu page for the T1 General income tax and benefit package for 2018. Individuals can select the link for their place of residence as of December 31, 2018, to get the forms and information needed to file a General income tax and benefit return for 2018. Each package includes the guide, the return, and related schedules, and the provincial information and forms. 05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing

The way to complete the 2017 M1, Individual Income Tax Return form on the web: To begin the blank, use the Fill & Sign Online button or tick the preview image of the document. The advanced tools of the editor will lead you through the editable PDF template. Enter your official identification and contact details. BIR Form No. 1702-EX Download Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT Under the Tax Code, as Amended, {Sec. 30 and those exempted in Sec. 27(C)} and Other Special Laws, with NO Other Taxable Income

201001180094 Department of Taxation and Finance Resident Income Tax Return New York State • New York City • Yonkers • MCTMT IT-201 Single Married filing joint return (enter spouse’s social security number above) 201001180094 Department of Taxation and Finance Resident Income Tax Return New York State • New York City • Yonkers • MCTMT IT-201 Single Married filing joint return (enter spouse’s social security number above)

The Income Tax Act, 1961, and the Income Tax Rules, 1962, require citizens to file their tax returns with the Income Tax Department at the end of every financial year and this form is a part of the filing process as specified by the Government of India. The due date for filing return with the Income Tax Department of India is 31 July every year. FORM ITR-V INDIAN INCOME TAX RETURN VERIFICATION FORM [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature] .

return form Even if you are not considered a mandatory e-Filer, ROS is the quickest, easiest and most convenient way to file your return and pay your tax. It allows you to file this form and to pay any tax (which will include Income Tax, Capital Gains Tax, PRSI and Universal Social Charge (USC)) due electronically. ROS also provides an instant FORM 306 - INCOME TAX WITHHOLDING RETURN NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28229 (3-2019) (A) Fill in this circle if this is an amended return. Account Number Due Date of Return (Ex: MM/DD/YYYY) Amount of payment by check Mail entire page to: North Dakota Office of State Tax Commissioner PO Box 5624 Bismarck, ND 58506-5624 WTH

Download Printable Form T 1 General In Pdf - The Latest Version Applicable For 2019. Fill Out The Income Tax And Benefit Return - Canada Online And Print It Out For Free. Form T 1 General Is Often Used In Canadian Tax Forms, Canadian Revenue Agency, Tax Forms And Financial. 540NR Tax Booklet 2018 Page 27 2018 Instructions for Long Form 540NR California Nonresident or Part-Year Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin

return form Even if you are not considered a mandatory e-Filer, ROS is the quickest, easiest and most convenient way to file your return and pay your tax. It allows you to file this form and to pay any tax (which will include Income Tax, Capital Gains Tax, PRSI and Universal Social Charge (USC)) due electronically. ROS also provides an instant An ITR12 return is an income tax return for an individual that stipulates all the income and allowable deductions claimed by the taxpayer for a year of assessment. read more Must I submit a return if I have multiple IRP5’s but the income for each one is less than R70 700? Yes, if you have more than one source of remuneration, of which each income is less than R70 700, a tax return must be submitted. read …

2017 M1 Individual Income Tax Return form Fill Out and Sign

Income Tax Return Form City of Stow Ohio Download Printable. Form 27C: Section 206C (1A) of Income Tax Act, 1961 states that a declaration must be made by a buyer for taking goods without tax collection. This statement is made through Form 27C. Download Link: Income Tax Return Forms (ITR) These are forms for various categories of people showing the tax liability., FORM 306 - INCOME TAX WITHHOLDING RETURN NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28229 (3-2019) (A) Fill in this circle if this is an amended return. Account Number Due Date of Return (Ex: MM/DD/YYYY) Amount of payment by check Mail entire page to: North Dakota Office of State Tax Commissioner PO Box 5624 Bismarck, ND 58506-5624 WTH.

2018 Instructions for Form 540 — California Resident Income Tax

2018 Instructions for Form 540 — California Resident Income Tax. 201001180094 Department of Taxation and Finance Resident Income Tax Return New York State • New York City • Yonkers • MCTMT IT-201 Single Married filing joint return (enter spouse’s social security number above), The Income Tax Act, 1961, and the Income Tax Rules, 1962, require citizens to file their tax returns with the Income Tax Department at the end of every financial year and this form is a part of the filing process as specified by the Government of India. The due date for filing return with the Income Tax Department of India is 31 July every year..

The Central Board of Direct Taxes (CBDT) has amended the Income-tax rules and has notified new income-tax return(ITR) forms 1 applicable for the financial year(FY) 2017-18 (assessment year 2018-19). Detailed instructions for filing these forms are yet to be notified by the CBDT. A simplified one page ITR Form-1 (Sahaj) has been notified for This fillable "Income Tax Return Form" is a document issued by the Ohio Department of Taxation specifically for Ohio residents.Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

Income Tax Form 16 is a certificate issued under section 203 of Income Tax Act for tax deduction at source from salary. Form 16 shows a detailed record of income tax deducted by the employer from the salary of the employees. Form16 contains complete details of salary, its components paid by the employer as well as the tax exempted from the salary. return form Even if you are not considered a mandatory e-Filer, ROS is the quickest, easiest and most convenient way to file your return and pay your tax. It allows you to file this form and to pay any tax (which will include Income Tax, Capital Gains Tax, PRSI and Universal Social Charge (USC)) due electronically. ROS also provides an instant

Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax . PDF; Fillable Form Self Assessment tax return forms and helpsheets for the current tax year . Skip to main content. GOV.UK uses cookies which are essential for the site to work. We also use non-essential cookies to

24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in CBDT has vide Notification No. 32/2019-Income Tax Dated 01/04/2019 released Form Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V. This post provide links to download such ITR and who can file such ITR. Also Read-Rule 12 of Income Tax Rules wef 1st April 2018 related to ITR of AY 2019-20

01-05-2019 · US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. For Tax Year 2018, you will no longer use Form 1040-A or Form 1040-EZ, but instead will use the redesigned Form 1040.Many people will only need to file Form 1040 and no schedules. 05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing

24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in CBDT has vide Notification No. 32/2019-Income Tax Dated 01/04/2019 released Form Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V. This post provide links to download such ITR and who can file such ITR. Also Read-Rule 12 of Income Tax Rules wef 1st April 2018 related to ITR of AY 2019-20

As the deductor is liable to deduct tax and file the TDS Return form as the supporting document, it is important to note that there are various types of TDS Return Forms for different situations. The type of TDS Return Form to be submitted is based on the Nature of Income of the deductee or the type of deductee who pays the TDS. Income Tax Form 16 is a certificate issued under section 203 of Income Tax Act for tax deduction at source from salary. Form 16 shows a detailed record of income tax deducted by the employer from the salary of the employees. Form16 contains complete details of salary, its components paid by the employer as well as the tax exempted from the salary.

Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax . PDF; Fillable Form Income Tax Form 16 is a certificate issued under section 203 of Income Tax Act for tax deduction at source from salary. Form 16 shows a detailed record of income tax deducted by the employer from the salary of the employees. Form16 contains complete details of salary, its components paid by the employer as well as the tax exempted from the salary.

The Central Board of Direct Taxes (CBDT) has amended the Income-tax rules and has notified new income-tax return(ITR) forms 1 applicable for the financial year(FY) 2017-18 (assessment year 2018-19). Detailed instructions for filing these forms are yet to be notified by the CBDT. A simplified one page ITR Form-1 (Sahaj) has been notified for TAX RETURN FOR INDIVIDUALS 2016 Sensitive (when completed) Page 3 I If you completed the Tax return for individuals (supplementary section) 2016, write here the amount from TOTAL SUPPLEMENT INCOME OR LOSS on page 15., .00 LOSS $,, .00 LOSS $, TOTAL INCOME OR LOSS Add up the income amounts and deduct any loss amount in the $

Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax . PDF; Fillable Form CBDT has vide Notification No. 32/2019-Income Tax Dated 01/04/2019 released Form Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V. This post provide links to download such ITR and who can file such ITR. Also Read-Rule 12 of Income Tax Rules wef 1st April 2018 related to ITR of AY 2019-20

01-05-2019 · US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. For Tax Year 2018, you will no longer use Form 1040-A or Form 1040-EZ, but instead will use the redesigned Form 1040.Many people will only need to file Form 1040 and no schedules. 31-12-2018 · This is the main menu page for the T1 General income tax and benefit package for 2018. Individuals can select the link for their place of residence as of December 31, 2018, to get the forms and information needed to file a General income tax and benefit return for 2018. Each package includes the guide, the return, and related schedules, and the provincial information and forms.

Income Tax Form 16 How to File Income Tax Return Using Form 16

Form T 1 GENERAL Download Printable PDF 2017 Income Tax. 540NR Tax Booklet 2018 Page 27 2018 Instructions for Long Form 540NR California Nonresident or Part-Year Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin, INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year FORM 2018-19 ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] ..

Income Tax Return Bureau of Internal Revenue

Income Tax Form 16 How to File Income Tax Return Using Form 16. 05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year FORM 2018-19 ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] ..

The Central Board of Direct Taxes (CBDT) has amended the Income-tax rules and has notified new income-tax return(ITR) forms 1 applicable for the financial year(FY) 2017-18 (assessment year 2018-19). Detailed instructions for filing these forms are yet to be notified by the CBDT. A simplified one page ITR Form-1 (Sahaj) has been notified for This fillable "Income Tax Return Form" is a document issued by the Ohio Department of Taxation specifically for Ohio residents.Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

Download Printable Form T 1 General In Pdf - The Latest Version Applicable For 2019. Fill Out The Income Tax And Benefit Return - Canada Online And Print It Out For Free. Form T 1 General Is Often Used In Canadian Tax Forms, Canadian Revenue Agency, Tax Forms And Financial. 10-05-2009 · On the request of my viewers I have uploaded some of the Income Tax forms in Excel, Word and PDF Format. Although, I haven’t uploaded all the forms but I uploaded most of the important forms. If any viewers have any form other then those uploaded in excel word format he can mail those to us at our

Income Tax Form 16 is a certificate issued under section 203 of Income Tax Act for tax deduction at source from salary. Form 16 shows a detailed record of income tax deducted by the employer from the salary of the employees. Form16 contains complete details of salary, its components paid by the employer as well as the tax exempted from the salary. report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G.

Personal Income Tax Booklet 2018 Page 9 2018 Instructions for Form 540 — California Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin 24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in

The Income Tax Act, 1961, and the Income Tax Rules, 1962, require citizens to file their tax returns with the Income Tax Department at the end of every financial year and this form is a part of the filing process as specified by the Government of India. The due date for filing return with the Income Tax Department of India is 31 July every year. Personal Income Tax Booklet 2018 Page 9 2018 Instructions for Form 540 — California Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin

05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing return form Even if you are not considered a mandatory e-Filer, ROS is the quickest, easiest and most convenient way to file your return and pay your tax. It allows you to file this form and to pay any tax (which will include Income Tax, Capital Gains Tax, PRSI and Universal Social Charge (USC)) due electronically. ROS also provides an instant

24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in 05-04-2019 · .Here we are providing Latest Income Tax Return Forms like ITR-1, ITR-2, ITR 2A, ITR-3, ITR-4, ITR-4S, ITR-5, ITR-6, And ITR-7 Form for AY 2019-20 or FY 2018-19. Download income tax return form for AY 2019-20. We are providing these Income Tax ITR Forms in PDF Format, Fillable Format, Excel Format and in JAVA Format, and Also Provide Filing

As the deductor is liable to deduct tax and file the TDS Return form as the supporting document, it is important to note that there are various types of TDS Return Forms for different situations. The type of TDS Return Form to be submitted is based on the Nature of Income of the deductee or the type of deductee who pays the TDS. FORM ITR-V INDIAN INCOME TAX RETURN VERIFICATION FORM [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature] .

return form Even if you are not considered a mandatory e-Filer, ROS is the quickest, easiest and most convenient way to file your return and pay your tax. It allows you to file this form and to pay any tax (which will include Income Tax, Capital Gains Tax, PRSI and Universal Social Charge (USC)) due electronically. ROS also provides an instant FORM 306 - INCOME TAX WITHHOLDING RETURN NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28229 (3-2019) (A) Fill in this circle if this is an amended return. Account Number Due Date of Return (Ex: MM/DD/YYYY) Amount of payment by check Mail entire page to: North Dakota Office of State Tax Commissioner PO Box 5624 Bismarck, ND 58506-5624 WTH

24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in FORM ITR-V INDIAN INCOME TAX RETURN VERIFICATION FORM [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature] .

24-01-2019 · Income Tax Challan ITNS 284 for payment of Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Challan 285: Income Tax Challan ITNS 285 for payment of Equalisation Levy Other commonly used forms ITR-1: ITR-I ( SAHAJ ) Income Tax Return form for AY 2018-19 and AY 2017-18 with formulas for auto calculation of Income Tax in Form 27C: Section 206C (1A) of Income Tax Act, 1961 states that a declaration must be made by a buyer for taking goods without tax collection. This statement is made through Form 27C. Download Link: Income Tax Return Forms (ITR) These are forms for various categories of people showing the tax liability.