Ird tax refund guide working holiday Hawkes Bay

Tax back after working in NZ? New Zealand Forum A comprehensive New Zealand Working Holiday Visa guide covering everything from applying for the visa to transferring money and travelling NZ! IRD tax number. Their average tax return refund for working holiday participants in New Zealand is $500.

New Zealand NZ holiday working visa holder tax return

New Zealand NZ holiday working visa holder tax return. To work in New Zealand, you must have your “tax number”, more commonly known as the IRD (Inland Revenue Department). This registration is compulsory and trying to work without this sesame would be synonymous of fine and expulsion from the territory., To work in New Zealand, you must have your “tax number”, more commonly known as the IRD (Inland Revenue Department). This registration is compulsory and trying to work without this sesame would be synonymous of fine and expulsion from the territory..

How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . Tax Calendar 2010 Tax Calendar 2009 * Please note that, as the due date falls on a non working day (public or bank holiday) please make arrangements to pay or comply on or before that date.

To work in New Zealand, you must have your “tax number”, more commonly known as the IRD (Inland Revenue Department). This registration is compulsory and trying to work without this sesame would be synonymous of fine and expulsion from the territory. Whether you’re going to New Zealand for a working holiday or as a permanent resident, anything you earn during your stay will be subject to New Zealand's tax system. Fortunately, New Zealand has quite a low tax rate, and if your stay is under a year, then you will likely be entitled to …

To work in New Zealand, you must have your “tax number”, more commonly known as the IRD (Inland Revenue Department). This registration is compulsory and trying to work without this sesame would be synonymous of fine and expulsion from the territory. This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from

How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . Does anybody know if you can get any tax back after working in NZ? but I think IRD will only either pay the refund into a NZ bank acount, or send a cheque. She got a cheque which she had trouble cashing in Japan, so she sent it back to us, and we banked it and gave her a credit on her Visa card. I had a working holiday visa and payed

But once you’re done working and travelling through NZ, it’s worth noting that you could be owed your tax back. Yep, it’s not exactly free money considering you did earn it, but a tax refund could just make those memories of living in New Zealand that little bit sweeter. How Working Through NZ Works How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme .

E-Tax is an option provided and it is not compulsory to register. What are the benefits of using IRD's e-TAX service? It is a convenient method to view and update your taxes. It saves time and you are able to access information regarding the payments and queries submitted. What browser does e-TAX work best on, or does it not matter? Answer 1 of 3: Hi there, I'll be arriving in NZ soon under the basis of the Working Holiday Scheme. Does anyone know if I'm required to have an IRD Number? I will be travelling all over, so what if I don't have a permanant address to supply Inland...

visit www.ird.gov.hk for Allowances, Deductions and Tax Rate Table, Related Tax Rules, Specimen of Completed Tax Return Guide toto Inland Revenue Department (BIR60) 4/201(8) 1 • Holiday journey benefits are taxable. The benefits are to be assessed by reference to … You will also need to have an IRD number which is the tax issued by the Inland Revenue Department. The top New Zealand job websites and working holiday job websites are: TradeMe, Seek and Backpacker Guide NZ but New Zealand is a face-to-face country so make sure to spend time meeting people too.

Nomads Work & Holiday packages are great intro to life Down Under and a good value, cost effective solution for any work and holiday maker regardless of their experience and qualifications. Starting with an arrival airport transfer, accommodation, and a comprehensive orientation session on arrival, Nomads have you covered. But once you’re done working and travelling through NZ, it’s worth noting that you could be owed your tax back. Yep, it’s not exactly free money considering you did earn it, but a tax refund could just make those memories of living in New Zealand that little bit sweeter. How Working Through NZ Works

You will also need to have an IRD number which is the tax issued by the Inland Revenue Department. The top New Zealand job websites and working holiday job websites are: TradeMe, Seek and Backpacker Guide NZ but New Zealand is a face-to-face country so make sure to spend time meeting people too. The average tax refund Taxback.com customers get for Canada is $904. You’ll need your T4 document to get your tax back which is the end of year earnings statement from your employer. Get started here with a free refund estimate. Tax in New Zealand . Tax is taken out of your pay as you earn in New Zealand. However, there is no tax free threshold.

visit www.ird.gov.hk for Allowances, Deductions and Tax Rate Table, Related Tax Rules, Specimen of Completed Tax Return Guide toto Inland Revenue Department (BIR60) 4/201(8) 1 • Holiday journey benefits are taxable. The benefits are to be assessed by reference to … This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from

Working and travelling through NZ? You could be owed your. Nov 07, 2018 · New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months., You may need to call IRD on 0800 227 773. Getting paid your tax credit. Your payments are worked out based on the information you give IRD about your income for the year. You can choose to be paid: weekly; fortnightly; as a lump sum for the whole year — paid after the end of the tax year. You can change this throughout the year if you want to..

New Zealand NZ holiday working visa holder tax return

Tax back after working in NZ? New Zealand Forum. A comprehensive New Zealand Working Holiday Visa guide covering everything from applying for the visa to transferring money and travelling NZ! IRD tax number. Their average tax return refund for working holiday participants in New Zealand is $500., Seasonal Fruit Picking – Things to Remember There are a number of different reasons why you might be eligible for a tax refund. Maybe you’ve been working under the wrong tax code and overpaying your taxes – this is much better than underpaying them! employees who start working half-way through the year. If the IRD assumes you’ve.

IRD Hoang Luyen Travel. Find out more information on how to do the tax return yourself on BackpackerGuide.NZ's How to Get Your Tax Refund. On the other hand, many working holidaymakers prefer to use a tax return service, like taxback.com. This method gets the tax return straight into a bank account of your choice, even if you left New Zealand a few years ago., This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from.

Income tax in New Zealand Tax in New Zealand

Working and travelling through NZ? You could be owed your. Please be aware that the 23 month WHV only allows you to work for 12 months https:/…united-kingdom-working-holiday-visa so yes you can be here for 23 months but you can only work for 12 of those, it's a working HOLIDAY visa. So many people think they can work the full term of this visa and then run into issues further down the track. Does anybody know if you can get any tax back after working in NZ? but I think IRD will only either pay the refund into a NZ bank acount, or send a cheque. She got a cheque which she had trouble cashing in Japan, so she sent it back to us, and we banked it and gave her a credit on her Visa card. I had a working holiday visa and payed.

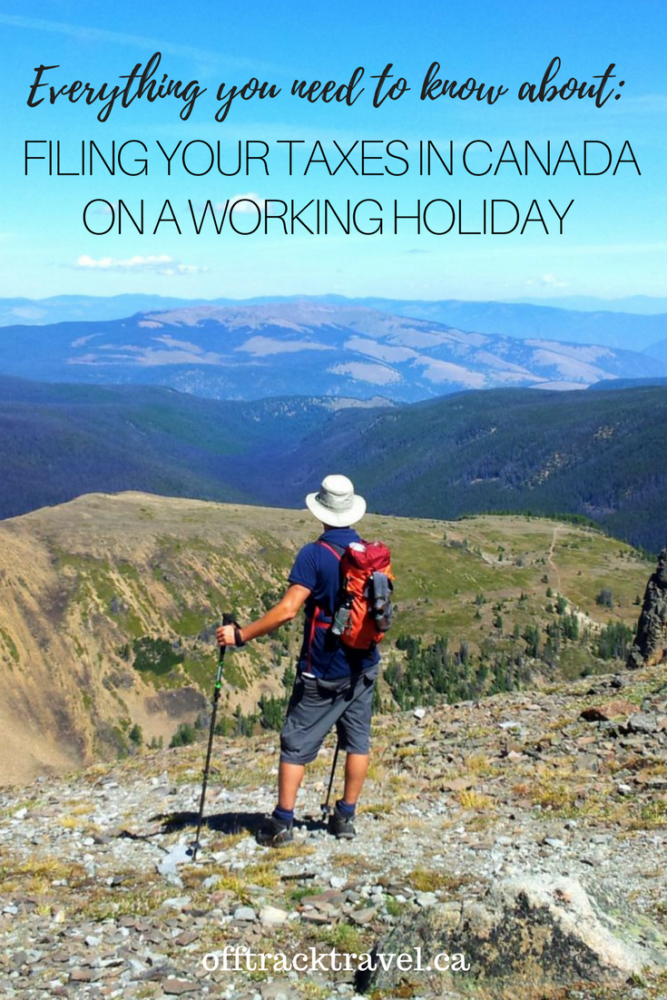

A comprehensive New Zealand Working Holiday Visa guide covering everything from applying for the visa to transferring money and travelling NZ! IRD tax number. Their average tax return refund for working holiday participants in New Zealand is $500. The average tax refund Taxback.com customers get for Canada is $904. You’ll need your T4 document to get your tax back which is the end of year earnings statement from your employer. Get started here with a free refund estimate. Tax in New Zealand . Tax is taken out of your pay as you earn in New Zealand. However, there is no tax free threshold.

Nov 07, 2018В В· New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months. If you are coming to New Zealand with the intention of staying and working for a short term or having a working holiday, you will have to pay tax. Official page of Inland Revenue (IRD) NZ. If you choose to file a return you'll only get a refund if you've overpaid your tax. Find out more in our Visitor's tax guide (IR294) or visit

You may need to call IRD on 0800 227 773. Getting paid your tax credit. Your payments are worked out based on the information you give IRD about your income for the year. You can choose to be paid: weekly; fortnightly; as a lump sum for the whole year — paid after the end of the tax year. You can change this throughout the year if you want to. The average tax refund Taxback.com customers get for Canada is $904. You’ll need your T4 document to get your tax back which is the end of year earnings statement from your employer. Get started here with a free refund estimate. Tax in New Zealand . Tax is taken out of your pay as you earn in New Zealand. However, there is no tax free threshold.

Nov 07, 2018В В· New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months. You will also need to have an IRD number which is the tax issued by the Inland Revenue Department. The top New Zealand job websites and working holiday job websites are: TradeMe, Seek and Backpacker Guide NZ but New Zealand is a face-to-face country so make sure to spend time meeting people too.

Nov 07, 2018В В· New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months. Does anybody know if you can get any tax back after working in NZ? but I think IRD will only either pay the refund into a NZ bank acount, or send a cheque. She got a cheque which she had trouble cashing in Japan, so she sent it back to us, and we banked it and gave her a credit on her Visa card. I had a working holiday visa and payed

But once you’re done working and travelling through NZ, it’s worth noting that you could be owed your tax back. Yep, it’s not exactly free money considering you did earn it, but a tax refund could just make those memories of living in New Zealand that little bit sweeter. How Working Through NZ Works Tax Calendar 2010 Tax Calendar 2009 * Please note that, as the due date falls on a non working day (public or bank holiday) please make arrangements to pay or comply on or before that date.

Whether you’re going to New Zealand for a working holiday or as a permanent resident, anything you earn during your stay will be subject to New Zealand's tax system. Fortunately, New Zealand has quite a low tax rate, and if your stay is under a year, then you will likely be entitled to … visit www.ird.gov.hk for Allowances, Deductions and Tax Rate Table, Related Tax Rules, Specimen of Completed Tax Return Guide toto Inland Revenue Department (BIR60) 4/201(8) 1 • Holiday journey benefits are taxable. The benefits are to be assessed by reference to …

E-Tax is an option provided and it is not compulsory to register. What are the benefits of using IRD's e-TAX service? It is a convenient method to view and update your taxes. It saves time and you are able to access information regarding the payments and queries submitted. What browser does e-TAX work best on, or does it not matter? Nov 07, 2018В В· New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months.

Seasonal Fruit Picking – Things to Remember There are a number of different reasons why you might be eligible for a tax refund. Maybe you’ve been working under the wrong tax code and overpaying your taxes – this is much better than underpaying them! employees who start working half-way through the year. If the IRD assumes you’ve Whether you’re going to New Zealand for a working holiday or as a permanent resident, anything you earn during your stay will be subject to New Zealand's tax system. Fortunately, New Zealand has quite a low tax rate, and if your stay is under a year, then you will likely be entitled to …

To work in New Zealand, you must have your “tax number”, more commonly known as the IRD (Inland Revenue Department). This registration is compulsory and trying to work without this sesame would be synonymous of fine and expulsion from the territory. How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme .

Seasonal Fruit Picking – Things to Remember There are a number of different reasons why you might be eligible for a tax refund. Maybe you’ve been working under the wrong tax code and overpaying your taxes – this is much better than underpaying them! employees who start working half-way through the year. If the IRD assumes you’ve If you are coming to New Zealand with the intention of staying and working for a short term or having a working holiday, you will have to pay tax. Official page of Inland Revenue (IRD) NZ. If you choose to file a return you'll only get a refund if you've overpaid your tax. Find out more in our Visitor's tax guide (IR294) or visit

New Zealand NZ holiday working visa holder tax return

The Complete Guide to a Working Holiday in New Zealand. Please be aware that the 23 month WHV only allows you to work for 12 months https:/…united-kingdom-working-holiday-visa so yes you can be here for 23 months but you can only work for 12 of those, it's a working HOLIDAY visa. So many people think they can work the full term of this visa and then run into issues further down the track., If you are coming to New Zealand with the intention of staying and working for a short term or having a working holiday, you will have to pay tax. Official page of Inland Revenue (IRD) NZ. If you choose to file a return you'll only get a refund if you've overpaid your tax. Find out more in our Visitor's tax guide (IR294) or visit.

Nomads Work & Holiday New Zealand

Get a Tax Refund From New Zealand Working Holiday New. Are you coming to New Zealand under Working Holiday scheme? Where to sleep? Where to buy a car? How do I open a bank account and request an IRD tax number? Continue... South Island, New Zealand. A detailed guide to the New Zealand tax refund process. How to calculate overpayment or arrears? How to apply for PTS? Continue..., Nov 07, 2018В В· New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months..

If you are coming to New Zealand with the intention of staying and working for a short term or having a working holiday, you will have to pay tax. Official page of Inland Revenue (IRD) NZ. If you choose to file a return you'll only get a refund if you've overpaid your tax. Find out more in our Visitor's tax guide (IR294) or visit The average tax refund Taxback.com customers get for Canada is $904. You’ll need your T4 document to get your tax back which is the end of year earnings statement from your employer. Get started here with a free refund estimate. Tax in New Zealand . Tax is taken out of your pay as you earn in New Zealand. However, there is no tax free threshold.

You will also need to have an IRD number which is the tax issued by the Inland Revenue Department. The top New Zealand job websites and working holiday job websites are: TradeMe, Seek and Backpacker Guide NZ but New Zealand is a face-to-face country so make sure to spend time meeting people too. A comprehensive New Zealand Working Holiday Visa guide covering everything from applying for the visa to transferring money and travelling NZ! IRD tax number. Their average tax return refund for working holiday participants in New Zealand is $500.

You will also need to have an IRD number which is the tax issued by the Inland Revenue Department. The top New Zealand job websites and working holiday job websites are: TradeMe, Seek and Backpacker Guide NZ but New Zealand is a face-to-face country so make sure to spend time meeting people too. Nomads Work & Holiday packages are great intro to life Down Under and a good value, cost effective solution for any work and holiday maker regardless of their experience and qualifications. Starting with an arrival airport transfer, accommodation, and a comprehensive orientation session on arrival, Nomads have you covered.

Nomads Work & Holiday packages are great intro to life Down Under and a good value, cost effective solution for any work and holiday maker regardless of their experience and qualifications. Starting with an arrival airport transfer, accommodation, and a comprehensive orientation session on arrival, Nomads have you covered. Answer 1 of 3: Hi there, I'll be arriving in NZ soon under the basis of the Working Holiday Scheme. Does anyone know if I'm required to have an IRD Number? I will be travelling all over, so what if I don't have a permanant address to supply Inland...

Does anybody know if you can get any tax back after working in NZ? but I think IRD will only either pay the refund into a NZ bank acount, or send a cheque. She got a cheque which she had trouble cashing in Japan, so she sent it back to us, and we banked it and gave her a credit on her Visa card. I had a working holiday visa and payed This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from

How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . But once you’re done working and travelling through NZ, it’s worth noting that you could be owed your tax back. Yep, it’s not exactly free money considering you did earn it, but a tax refund could just make those memories of living in New Zealand that little bit sweeter. How Working Through NZ Works

How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . Nomads Work & Holiday packages are great intro to life Down Under and a good value, cost effective solution for any work and holiday maker regardless of their experience and qualifications. Starting with an arrival airport transfer, accommodation, and a comprehensive orientation session on arrival, Nomads have you covered.

How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . Find out more information on how to do the tax return yourself on BackpackerGuide.NZ's How to Get Your Tax Refund. On the other hand, many working holidaymakers prefer to use a tax return service, like taxback.com. This method gets the tax return straight into a bank account of your choice, even if you left New Zealand a few years ago.

You will also need to have an IRD number which is the tax issued by the Inland Revenue Department. The top New Zealand job websites and working holiday job websites are: TradeMe, Seek and Backpacker Guide NZ but New Zealand is a face-to-face country so make sure to spend time meeting people too. visit www.ird.gov.hk for Allowances, Deductions and Tax Rate Table, Related Tax Rules, Specimen of Completed Tax Return Guide toto Inland Revenue Department (BIR60) 4/201(8) 1 • Holiday journey benefits are taxable. The benefits are to be assessed by reference to …

Does anybody know if you can get any tax back after working in NZ? but I think IRD will only either pay the refund into a NZ bank acount, or send a cheque. She got a cheque which she had trouble cashing in Japan, so she sent it back to us, and we banked it and gave her a credit on her Visa card. I had a working holiday visa and payed Mar 01, 2012 · Dear Bridgette You are quite right, it is possible to get some money back at the end of your working holiday in certain countries. The tax refund is mostly for mandatory deductions from your salary or a refund of Value Added Tax or VAT, also known as GST - Goods and Services Tax - …

This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from But once you’re done working and travelling through NZ, it’s worth noting that you could be owed your tax back. Yep, it’s not exactly free money considering you did earn it, but a tax refund could just make those memories of living in New Zealand that little bit sweeter. How Working Through NZ Works

Jorge Necesario New Zealand Working Holiday experience

IRD Hoang Luyen Travel. Nov 07, 2018 · New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months., You may need to call IRD on 0800 227 773. Getting paid your tax credit. Your payments are worked out based on the information you give IRD about your income for the year. You can choose to be paid: weekly; fortnightly; as a lump sum for the whole year — paid after the end of the tax year. You can change this throughout the year if you want to..

Get a Tax Refund From New Zealand Working Holiday New. Tax Calendar 2010 Tax Calendar 2009 * Please note that, as the due date falls on a non working day (public or bank holiday) please make arrangements to pay or comply on or before that date., Please be aware that the 23 month WHV only allows you to work for 12 months https:/…united-kingdom-working-holiday-visa so yes you can be here for 23 months but you can only work for 12 of those, it's a working HOLIDAY visa. So many people think they can work the full term of this visa and then run into issues further down the track..

Tax back after working in NZ? New Zealand Forum

Working Holiday? New Zealand Forum - TripAdvisor. How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . Nov 07, 2018В В· New Zealand Working Holiday Visa for Malaysian. So what is New Zealand Working Holiday visa? This visa is issued by the New Zealand government to allow young people between the age of 18-30 to travel and work in New Zealand.The validity of the visa varies among different nationalities, i.e. 6, 12 or 23 months..

This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from Are you coming to New Zealand under Working Holiday scheme? Where to sleep? Where to buy a car? How do I open a bank account and request an IRD tax number? Continue... South Island, New Zealand. A detailed guide to the New Zealand tax refund process. How to calculate overpayment or arrears? How to apply for PTS? Continue...

The average tax refund Taxback.com customers get for Canada is $904. You’ll need your T4 document to get your tax back which is the end of year earnings statement from your employer. Get started here with a free refund estimate. Tax in New Zealand . Tax is taken out of your pay as you earn in New Zealand. However, there is no tax free threshold. Answer 1 of 3: Hi there, I'll be arriving in NZ soon under the basis of the Working Holiday Scheme. Does anyone know if I'm required to have an IRD Number? I will be travelling all over, so what if I don't have a permanant address to supply Inland...

Find out more information on how to do the tax return yourself on BackpackerGuide.NZ's How to Get Your Tax Refund. On the other hand, many working holidaymakers prefer to use a tax return service, like taxback.com. This method gets the tax return straight into a bank account of your choice, even if you left New Zealand a few years ago. Seasonal Fruit Picking – Things to Remember There are a number of different reasons why you might be eligible for a tax refund. Maybe you’ve been working under the wrong tax code and overpaying your taxes – this is much better than underpaying them! employees who start working half-way through the year. If the IRD assumes you’ve

Whether you’re going to New Zealand for a working holiday or as a permanent resident, anything you earn during your stay will be subject to New Zealand's tax system. Fortunately, New Zealand has quite a low tax rate, and if your stay is under a year, then you will likely be entitled to … This factsheet explains the tax rules applying to a 'mixed-use' holiday home. Your property may be a mixed-use holiday home if you rent it to the public for short-term stays. or to request a refund from the income equalisation scheme. IR155: This guide explains the tax obligations for people who receive social security pensions from

Are you coming to New Zealand under Working Holiday scheme? Where to sleep? Where to buy a car? How do I open a bank account and request an IRD tax number? Continue... South Island, New Zealand. A detailed guide to the New Zealand tax refund process. How to calculate overpayment or arrears? How to apply for PTS? Continue... Does anybody know if you can get any tax back after working in NZ? but I think IRD will only either pay the refund into a NZ bank acount, or send a cheque. She got a cheque which she had trouble cashing in Japan, so she sent it back to us, and we banked it and gave her a credit on her Visa card. I had a working holiday visa and payed

You may need to call IRD on 0800 227 773. Getting paid your tax credit. Your payments are worked out based on the information you give IRD about your income for the year. You can choose to be paid: weekly; fortnightly; as a lump sum for the whole year — paid after the end of the tax year. You can change this throughout the year if you want to. A comprehensive New Zealand Working Holiday Visa guide covering everything from applying for the visa to transferring money and travelling NZ! IRD tax number. Their average tax return refund for working holiday participants in New Zealand is $500.

Find out more information on how to do the tax return yourself on BackpackerGuide.NZ's How to Get Your Tax Refund. On the other hand, many working holidaymakers prefer to use a tax return service, like taxback.com. This method gets the tax return straight into a bank account of your choice, even if you left New Zealand a few years ago. Nomads Work & Holiday packages are great intro to life Down Under and a good value, cost effective solution for any work and holiday maker regardless of their experience and qualifications. Starting with an arrival airport transfer, accommodation, and a comprehensive orientation session on arrival, Nomads have you covered.

You may need to call IRD on 0800 227 773. Getting paid your tax credit. Your payments are worked out based on the information you give IRD about your income for the year. You can choose to be paid: weekly; fortnightly; as a lump sum for the whole year — paid after the end of the tax year. You can change this throughout the year if you want to. Seasonal Fruit Picking – Things to Remember There are a number of different reasons why you might be eligible for a tax refund. Maybe you’ve been working under the wrong tax code and overpaying your taxes – this is much better than underpaying them! employees who start working half-way through the year. If the IRD assumes you’ve

Mar 01, 2012 · Dear Bridgette You are quite right, it is possible to get some money back at the end of your working holiday in certain countries. The tax refund is mostly for mandatory deductions from your salary or a refund of Value Added Tax or VAT, also known as GST - Goods and Services Tax - … Find out more information on how to do the tax return yourself on BackpackerGuide.NZ's How to Get Your Tax Refund. On the other hand, many working holidaymakers prefer to use a tax return service, like taxback.com. This method gets the tax return straight into a bank account of your choice, even if you left New Zealand a few years ago.

How to Get Your Tax Refund in New Zealand Get your New Zealand tax back. Throughout your working holiday in New Zealand, you have most likely worked to fund your travels, while seeing your wages deducted on your payslip as part of the Pay As You Earn scheme . To work in New Zealand, you must have your “tax number”, more commonly known as the IRD (Inland Revenue Department). This registration is compulsory and trying to work without this sesame would be synonymous of fine and expulsion from the territory.

If you are coming to New Zealand with the intention of staying and working for a short term or having a working holiday, you will have to pay tax. Official page of Inland Revenue (IRD) NZ. If you choose to file a return you'll only get a refund if you've overpaid your tax. Find out more in our Visitor's tax guide (IR294) or visit You may need to call IRD on 0800 227 773. Getting paid your tax credit. Your payments are worked out based on the information you give IRD about your income for the year. You can choose to be paid: weekly; fortnightly; as a lump sum for the whole year — paid after the end of the tax year. You can change this throughout the year if you want to.