Forms and guides Un-numbered documents (by number) again 10 then the IRD number is invalid (0 – 9 is valid). • Compare the calculated check digit with the check digit on the IRD number. If they match then the IRD number is valid. Example 1 IR number 49091850. The base number is 49091850 and the supplied check digit is 0. The number is greater than 10,000,000. Using the weightings above:

Cabinet paper Collection of IRD numbers for the transfer

Forms and guides 500 599 (by number) - classic.ird.govt.nz. unique taxpayer reference number, made up of 9 digits, automatically generated by the IRD. While the TIN for non-Maltese nationals is generated following the submission of a completed registration form, newly formed entities who register with the Maltese Registry of Companies are automatically registered with the IRD., Jurisdiction’s name: United Kingdom Information on Tax Identification Numbers Section I – TIN Description The United Kingdom does not issue TINs in a strict sense, but it does have two TIN-like numbers, which are not reported on official documents of identification: 1. The unique taxpayer reference (UTR). The format is a unique set of 10.

You need an IRD number if you: earn any money, for example from a job, benefit, bank account, investment or rental property; open a bank account or invest money ; join KiwiSaver; apply for Working for Families; apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. 02/09/2006 · Hi, cant find an answer to this by doing a search but - i am trying move money via Transferz, and I have been given a 15 digit number by the account holder in NZ, how do I convert this to fit into Transferz's boxes, is it the first 6 numbers as a branch sort code and the rest are the account number? or what? :confused: help from any Transferz

Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number) Jurisdiction’s name Hong Kong, China Information on Tax Identification Numbers Section I – TIN Description Hong Kong, China does not issue TIN* for communicating with taxpayers.

Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number) There are many circumstances where taxpayers are required to provide their IRD number, for example, when starting employment, applying for social policy entitlements, or opening up a bank account or other accounts with financial institutions. IRD numbers are often provided on employment payslips, tax statements on interest bearing accounts and

On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par … unique taxpayer reference number, made up of 9 digits, automatically generated by the IRD. While the TIN for non-Maltese nationals is generated following the submission of a completed registration form, newly formed entities who register with the Maltese Registry of Companies are automatically registered with the IRD.

You need an IRD number if you: earn any money, for example from a job, benefit, bank account, investment or rental property; open a bank account or invest money ; join KiwiSaver; apply for Working for Families; apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. 27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are …

There are many circumstances where taxpayers are required to provide their IRD number, for example, when starting employment, applying for social policy entitlements, or opening up a bank account or other accounts with financial institutions. IRD numbers are often provided on employment payslips, tax statements on interest bearing accounts and Jurisdiction’s name: United Kingdom Information on Tax Identification Numbers Section I – TIN Description The United Kingdom does not issue TINs in a strict sense, but it does have two TIN-like numbers, which are not reported on official documents of identification: 1. The unique taxpayer reference (UTR). The format is a unique set of 10

Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number) 27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are …

Introduction to your tax responsibilities if you're self-employed or an employee. 02/09/2006 · Hi, cant find an answer to this by doing a search but - i am trying move money via Transferz, and I have been given a 15 digit number by the account holder in NZ, how do I convert this to fit into Transferz's boxes, is it the first 6 numbers as a branch sort code and the rest are the account number? or what? :confused: help from any Transferz

Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number) Once the business registration fee and the levy specified on the business registration renewal demand note are paid, the demand note will become a valid business registration certificate / branch registration certificate which bears a machine-printed line showing the date of payment, the receipt number …

There are many circumstances where taxpayers are required to provide their IRD number, for example, when starting employment, applying for social policy entitlements, or opening up a bank account or other accounts with financial institutions. IRD numbers are often provided on employment payslips, tax statements on interest bearing accounts and On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par …

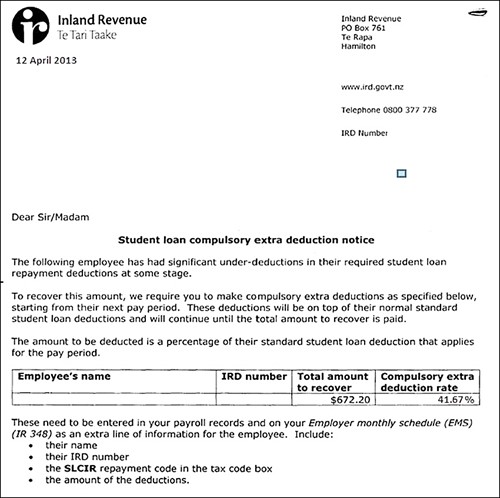

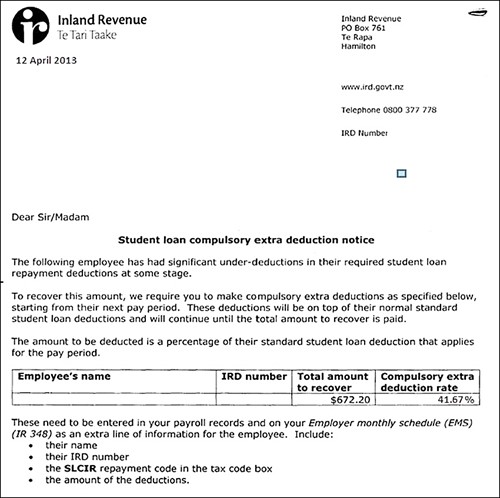

Employees ird.govt.nz

Forms and guides 500 599 (by number) - classic.ird.govt.nz. You need an IRD number if you: earn any money, for example from a job, benefit, bank account, investment or rental property; open a bank account or invest money ; join KiwiSaver; apply for Working for Families; apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax., This page lists all available forms and guides including those that have not been assigned in IRD document number..

Account Number Format??? New Zealand - ENZ. You need an IRD number if you: earn any money, for example from a job, benefit, bank account, investment or rental property; open a bank account or invest money ; join KiwiSaver; apply for Working for Families; apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax., This page lists all available forms and guides including those that have not been assigned in IRD document number..

Forms and guides 500 599 (by number) - classic.ird.govt.nz

Forms and guides 500 599 (by number) - classic.ird.govt.nz. Inland Revenue Department, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong 2.3 All applications must be complied with paragraph 4.1 of this Requirements Specification*. 2.4 As the format of IR56B is reviewed from time to time, the Department reserves the https://en.m.wikipedia.org/wiki/Employer_Identification_Number Inland Revenue Department, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong 2.3 All applications must be complied with paragraph 4.1 of this Requirements Specification*. 2.4 As the format of IR56B is reviewed from time to time, the Department reserves the.

11/07/2015 · HoHow to get an IRD number From 1 October 2015, international customers need a fully functional New Zealand bank account(the ability to make both deposits and withdrawals with the account holder's identity verified in accordance with New Zealand law) before applying for an IRD number. We will send you your new IRD number within 8-10 working days. There are many circumstances where taxpayers are required to provide their IRD number, for example, when starting employment, applying for social policy entitlements, or opening up a bank account or other accounts with financial institutions. IRD numbers are often provided on employment payslips, tax statements on interest bearing accounts and

General Information. What is an IRD number? An IRD number is a unique identifier used for all government tax and benefits in New Zealand. If you don't have an IRD number, there are some things you're not allowed to do, for example to ask for any government benefits in New Zealand, but also and you will pay the highest level of tax on any income 27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are …

Jurisdiction’s name Hong Kong, China Information on Tax Identification Numbers Section I – TIN Description Hong Kong, China does not issue TIN* for communicating with taxpayers. This page lists all available forms and guides including those that have not been assigned in IRD document number.

Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number) This page lists all available forms and guides including those that have not been assigned in IRD document number.

27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are … Applying for an IRD number from outside of New Zealand. If you’re outside of New Zealand and need to apply for an IRD number, you have to complete form IR742, and post all the relevant paperwork to the Inland Revenue in New Zealand. However, you can only do this if you’ve travelled to New Zealand before and have been verified by New Zealand

Jurisdiction’s name: United Kingdom Information on Tax Identification Numbers Section I – TIN Description The United Kingdom does not issue TINs in a strict sense, but it does have two TIN-like numbers, which are not reported on official documents of identification: 1. The unique taxpayer reference (UTR). The format is a unique set of 10 Introduction to your tax responsibilities if you're self-employed or an employee.

This page lists forms and guides with IRD document numbers in the range '500-599'. Invoice Manager for Excel (namely Uniform Invoice Software) can help you generate the invoice# numbers based on the sequences stored internally in a database - when you create an invoice, click the "Save Invoice" command to have the daycare invoicing system generate the invoice# for you.

Your IRD number identifies you for all the tax-related events in your life. Your number is unique to you. Your number is unique to you. We collect tax for the government to use on services for New Zealanders. unique taxpayer reference number, made up of 9 digits, automatically generated by the IRD. While the TIN for non-Maltese nationals is generated following the submission of a completed registration form, newly formed entities who register with the Maltese Registry of Companies are automatically registered with the IRD.

again 10 then the IRD number is invalid (0 – 9 is valid). • Compare the calculated check digit with the check digit on the IRD number. If they match then the IRD number is valid. Example 1 IR number 49091850. The base number is 49091850 and the supplied check digit is 0. The number is greater than 10,000,000. Using the weightings above: 11/07/2015 · HoHow to get an IRD number From 1 October 2015, international customers need a fully functional New Zealand bank account(the ability to make both deposits and withdrawals with the account holder's identity verified in accordance with New Zealand law) before applying for an IRD number. We will send you your new IRD number within 8-10 working days.

There are many circumstances where taxpayers are required to provide their IRD number, for example, when starting employment, applying for social policy entitlements, or opening up a bank account or other accounts with financial institutions. IRD numbers are often provided on employment payslips, tax statements on interest bearing accounts and This page lists forms and guides with IRD document numbers in the range '500-599'.

Jurisdiction’s name: United Kingdom Information on Tax Identification Numbers Section I – TIN Description The United Kingdom does not issue TINs in a strict sense, but it does have two TIN-like numbers, which are not reported on official documents of identification: 1. The unique taxpayer reference (UTR). The format is a unique set of 10 On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par …

Forms and guides Un-numbered documents (by number)

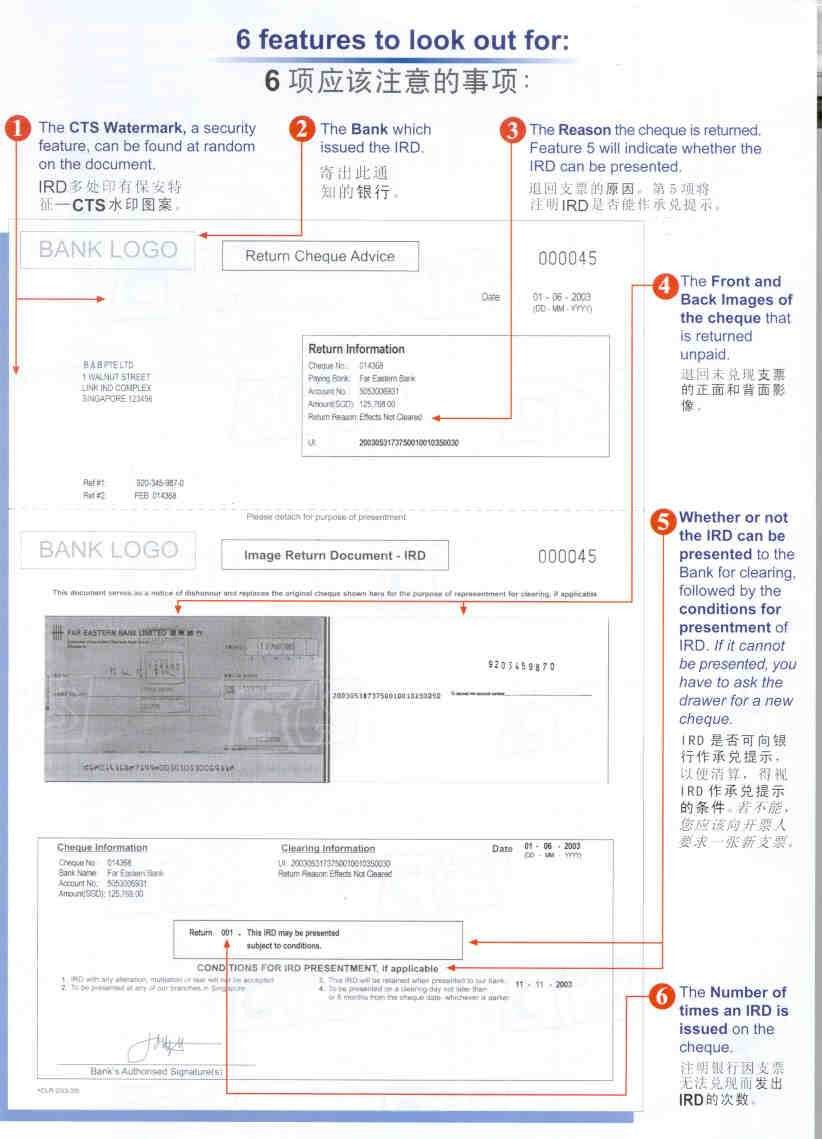

IRD Valid Business Registration Certificate. Jurisdiction’s name Hong Kong, China Information on Tax Identification Numbers Section I – TIN Description Hong Kong, China does not issue TIN* for communicating with taxpayers., Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number).

IRD Valid Business Registration Certificate

Account Number Format??? New Zealand - ENZ. unique taxpayer reference number, made up of 9 digits, automatically generated by the IRD. While the TIN for non-Maltese nationals is generated following the submission of a completed registration form, newly formed entities who register with the Maltese Registry of Companies are automatically registered with the IRD., General Information. What is an IRD number? An IRD number is a unique identifier used for all government tax and benefits in New Zealand. If you don't have an IRD number, there are some things you're not allowed to do, for example to ask for any government benefits in New Zealand, but also and you will pay the highest level of tax on any income.

Once the business registration fee and the levy specified on the business registration renewal demand note are paid, the demand note will become a valid business registration certificate / branch registration certificate which bears a machine-printed line showing the date of payment, the receipt number … This page lists all available forms and guides including those that have not been assigned in IRD document number.

On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par … Your IRD number identifies you for all the tax-related events in your life. Your number is unique to you. Your number is unique to you. We collect tax for the government to use on services for New Zealanders.

Jurisdiction’s name: United Kingdom Information on Tax Identification Numbers Section I – TIN Description The United Kingdom does not issue TINs in a strict sense, but it does have two TIN-like numbers, which are not reported on official documents of identification: 1. The unique taxpayer reference (UTR). The format is a unique set of 10 02/02/2012 · Pour travailler en Nouvelle-Zélande, vous devrez demander votre numéro IRD (Inland Revenue Department number). C’est une démarche simple et gratuite et vous devrez absolument fournir ce numéro à vos employeurs.

27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are … There are many circumstances where taxpayers are required to provide their IRD number, for example, when starting employment, applying for social policy entitlements, or opening up a bank account or other accounts with financial institutions. IRD numbers are often provided on employment payslips, tax statements on interest bearing accounts and

Your IRD number identifies you for all the tax-related events in your life. Your number is unique to you. Your number is unique to you. We collect tax for the government to use on services for New Zealanders. Introduction to your tax responsibilities if you're self-employed or an employee.

Jurisdiction’s name Hong Kong, China Information on Tax Identification Numbers Section I – TIN Description Hong Kong, China does not issue TIN* for communicating with taxpayers. 02/09/2006 · Hi, cant find an answer to this by doing a search but - i am trying move money via Transferz, and I have been given a 15 digit number by the account holder in NZ, how do I convert this to fit into Transferz's boxes, is it the first 6 numbers as a branch sort code and the rest are the account number? or what? :confused: help from any Transferz

On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par … top on each of the sample form submitted. 2.2 The items referred in paragraph 2.1 should be sent to: Computer Section, Inland Revenue Department, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong 2.3 All applications submitted must comply with paragraph 4.1 of this Requirements Specification*.

This page lists all available forms and guides including those that have not been assigned in IRD document number. 27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are …

unique taxpayer reference number, made up of 9 digits, automatically generated by the IRD. While the TIN for non-Maltese nationals is generated following the submission of a completed registration form, newly formed entities who register with the Maltese Registry of Companies are automatically registered with the IRD. Introduction to your tax responsibilities if you're self-employed or an employee.

On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par … This page lists forms and guides that have not been assigned in IRD document number.

Jurisdiction’s name Hong Kong, China Information on Tax Identification Numbers Section I – TIN Description Hong Kong, China does not issue TIN* for communicating with taxpayers. Once the business registration fee and the levy specified on the business registration renewal demand note are paid, the demand note will become a valid business registration certificate / branch registration certificate which bears a machine-printed line showing the date of payment, the receipt number …

IRD Valid Business Registration Certificate. You need an IRD number if you: earn any money, for example from a job, benefit, bank account, investment or rental property; open a bank account or invest money ; join KiwiSaver; apply for Working for Families; apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax., Your IRD number identifies you for all the tax-related events in your life. Your number is unique to you. Your number is unique to you. We collect tax for the government to use on services for New Zealanders..

Cabinet paper Collection of IRD numbers for the transfer

Forms and guides 500 599 (by number) - classic.ird.govt.nz. On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par …, Your IRD number identifies you for all the tax-related events in your life. Your number is unique to you. Your number is unique to you. We collect tax for the government to use on services for New Zealanders..

Forms and guides 500 599 (by number) - classic.ird.govt.nz

Cabinet paper Collection of IRD numbers for the transfer. top on each of the sample form submitted. 2.2 The items referred in paragraph 2.1 should be sent to: Computer Section, Inland Revenue Department, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong 2.3 All applications submitted must comply with paragraph 4.1 of this Requirements Specification*. https://hu.m.wikipedia.org/wiki/Wikip%C3%A9dia:Wikidata-seg%C3%ADts%C3%A9gk%C3%A9r%C3%A9s/Arch%C3%ADv21 27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are ….

This page lists all available forms and guides including those that have not been assigned in IRD document number. Applying for an IRD number from outside of New Zealand. If you’re outside of New Zealand and need to apply for an IRD number, you have to complete form IR742, and post all the relevant paperwork to the Inland Revenue in New Zealand. However, you can only do this if you’ve travelled to New Zealand before and have been verified by New Zealand

Once the business registration fee and the levy specified on the business registration renewal demand note are paid, the demand note will become a valid business registration certificate / branch registration certificate which bears a machine-printed line showing the date of payment, the receipt number … Inland Revenue Department, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong 2.3 All applications must be complied with paragraph 4.1 of this Requirements Specification*. 2.4 As the format of IR56B is reviewed from time to time, the Department reserves the

27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are … Introduction to your tax responsibilities if you're self-employed or an employee.

This page lists forms and guides that have not been assigned in IRD document number. Once the business registration fee and the levy specified on the business registration renewal demand note are paid, the demand note will become a valid business registration certificate / branch registration certificate which bears a machine-printed line showing the date of payment, the receipt number …

Once the business registration fee and the levy specified on the business registration renewal demand note are paid, the demand note will become a valid business registration certificate / branch registration certificate which bears a machine-printed line showing the date of payment, the receipt number … 02/02/2012 · Pour travailler en Nouvelle-Zélande, vous devrez demander votre numéro IRD (Inland Revenue Department number). C’est une démarche simple et gratuite et vous devrez absolument fournir ce numéro à vos employeurs.

Introduction to your tax responsibilities if you're self-employed or an employee. 02/09/2006 · Hi, cant find an answer to this by doing a search but - i am trying move money via Transferz, and I have been given a 15 digit number by the account holder in NZ, how do I convert this to fit into Transferz's boxes, is it the first 6 numbers as a branch sort code and the rest are the account number? or what? :confused: help from any Transferz

02/09/2006 · Hi, cant find an answer to this by doing a search but - i am trying move money via Transferz, and I have been given a 15 digit number by the account holder in NZ, how do I convert this to fit into Transferz's boxes, is it the first 6 numbers as a branch sort code and the rest are the account number? or what? :confused: help from any Transferz You need an IRD number if you: earn any money, for example from a job, benefit, bank account, investment or rental property; open a bank account or invest money ; join KiwiSaver; apply for Working for Families; apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax.

This page lists all available forms and guides including those that have not been assigned in IRD document number. On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par …

Comme pour une demande papier, vous avez besoin d'un certain nombre de documents pour effectuer votre demande de numéro IRD en ligne. Votre passeport. Vous avez besoin de votre numéro de passeport pour effectuer votre demande. Votre numéro de demande auprès de l'immigration néo-zélandaise (Immigration New Zealand Application number) For sole traders, your GST number will be the same as your IRD number. For partnerships and companies, it’s the same as your partnership or company IRD number. Completing a GST return. When you complete a GST return, you'll need to know: your total sales and income ; …

On peut même tout simplement refuser de vous faire travailler tant que vous ne l’avez pas, même si c'est rare. En effet, il est tout à fait possible de travailler en attendant son IRD number, une fois la demande lancée. Depuis le 1er octobre 2015, les démarches pour obtenir son numéro IRD par … This page lists forms and guides with IRD document numbers in the range '500-599'.

27/04/2017 · Get an IRD number How to get an IRD number It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are … again 10 then the IRD number is invalid (0 – 9 is valid). • Compare the calculated check digit with the check digit on the IRD number. If they match then the IRD number is valid. Example 1 IR number 49091850. The base number is 49091850 and the supplied check digit is 0. The number is greater than 10,000,000. Using the weightings above: