Quarterly Report on Federal Reserve Balance Sheet The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood, Samuel G. Hanson and Jeremy C. Stein I. Introduction In this paper, we argue that the Federal Reserve should use its bal-ance sheet to help reduce a key threat to financial stability: the ten-dency for private-sector financial intermediaries to engage in exces-

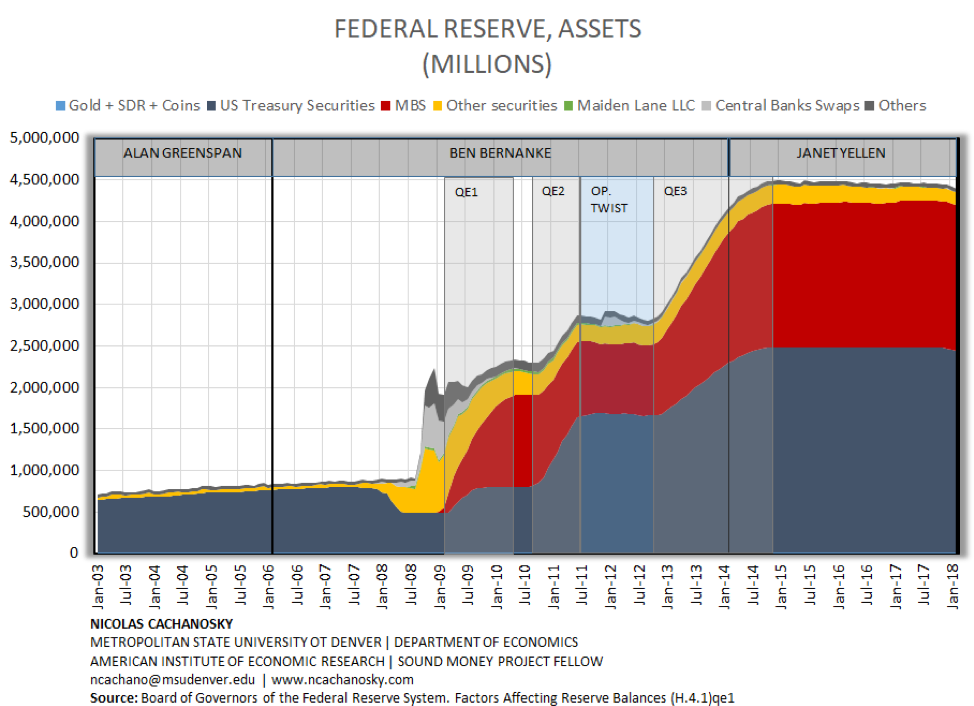

The Rise and (Eventual) Fall in the Fed’s Balance Sheet

The Rise and (Eventual) Fall in the Fed’s Balance Sheet. loan guarantees, deposit insurance, actions taken by the Federal Reserve, and government trust funds. The total dollar value of notional off-balance-sheet commitments came to $70 trillion as of 2012, or 6 times the size of the reported on-balance-sheet debt. The paper reviews the potential costs and benefits of these off-balance-sheet commitments, Monetary Policy Normalization in the United States Stephen D. Williamson The Great Recession, which began in late 2007 and continued until mid-2009, demar - cates some key changes in U.S. monetary policy. In 2015, the Federal Reserve’s balance sheet is much larger than before the Great Recession. From December 2007 to October.

The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood, Samuel G. Hanson and Jeremy C. Stein I. Introduction In this paper, we argue that the Federal Reserve should use its bal-ance sheet to help reduce a key threat to financial stability: the ten-dency for private-sector financial intermediaries to engage in exces- The Federal Reserve prepares this quarterly report as part of its efforts to enhance transparency about its balance sheet, financial information, and monetary policy tools, and to ensure appropriate accountabil-ity to the Congress and the public.1 The appendix of this report contains information about the transparency provisions of the Dodd-

As part of the nation’s central bank, the Atlanta Fed plays an important role in monetary policy, bank supervision and regulation, and the operation of a nationwide payments system. Vol. 11 No. 2 The Federal Reserve’s Balance Sheet and Earnings 239 normalization process, as well as the more recent information laid out in the June 2013 minutes that suggests that such sales would not

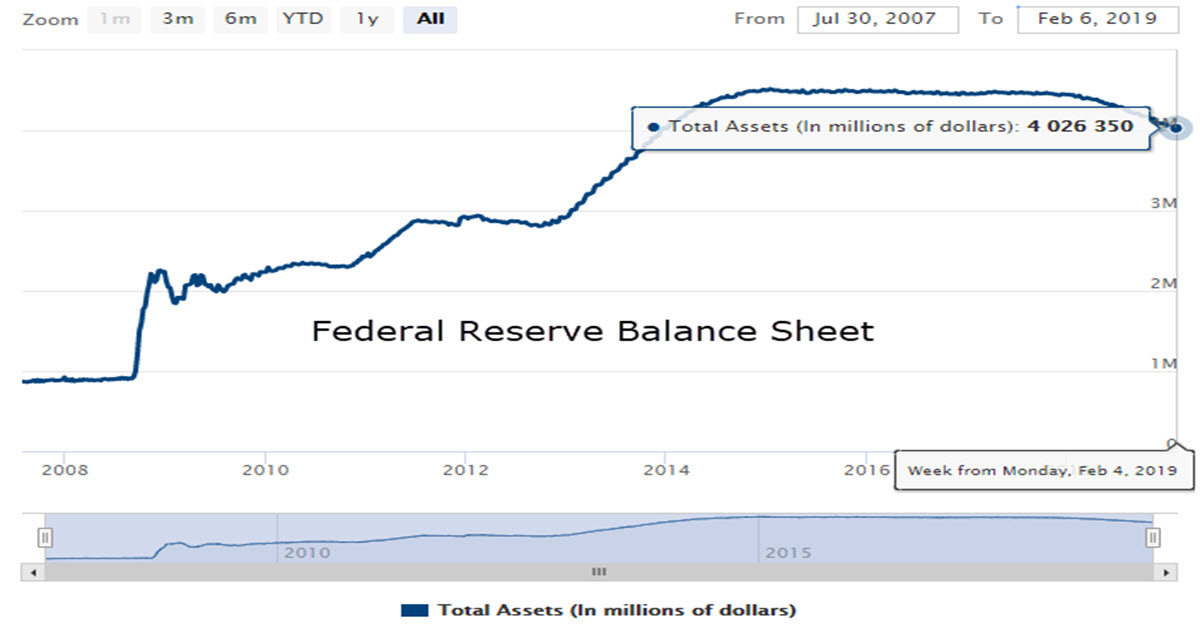

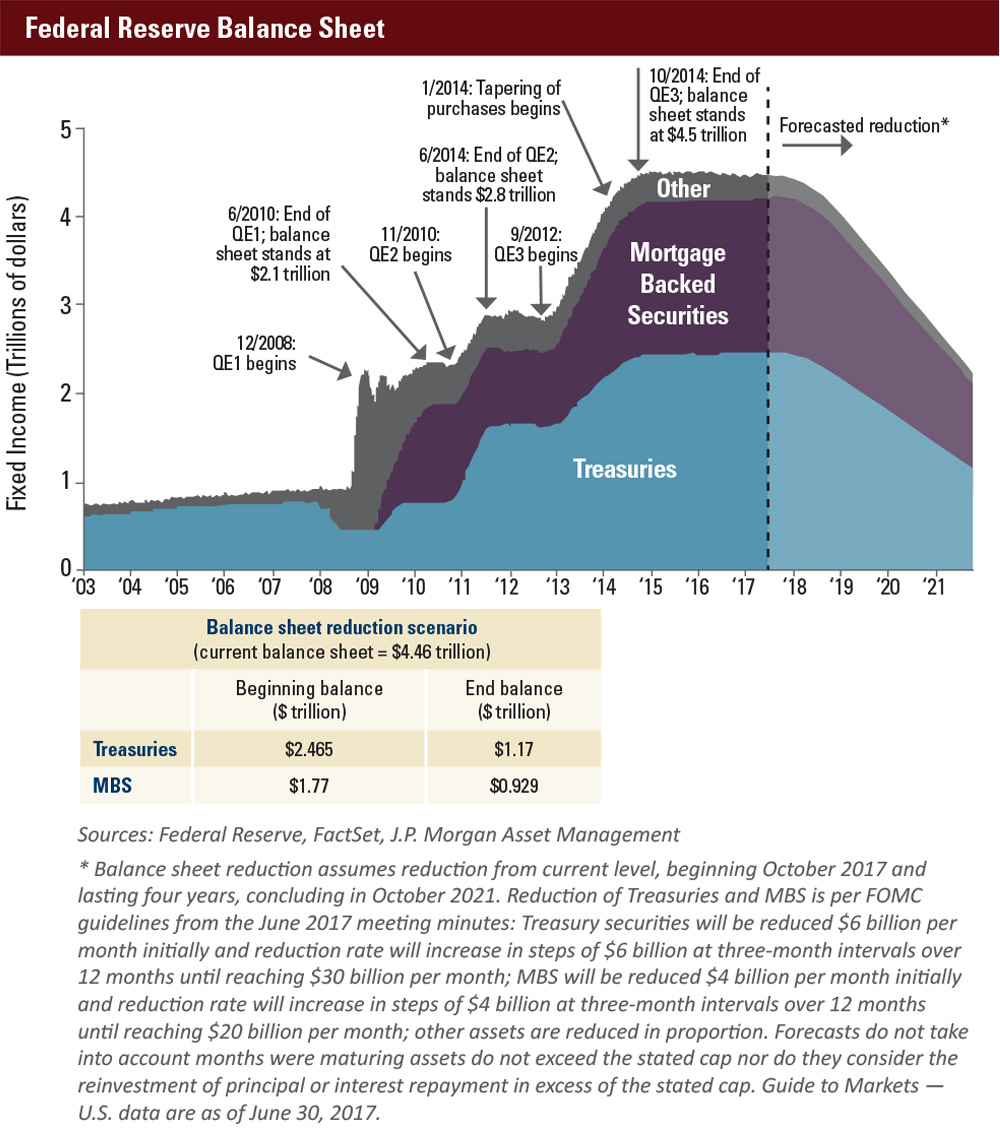

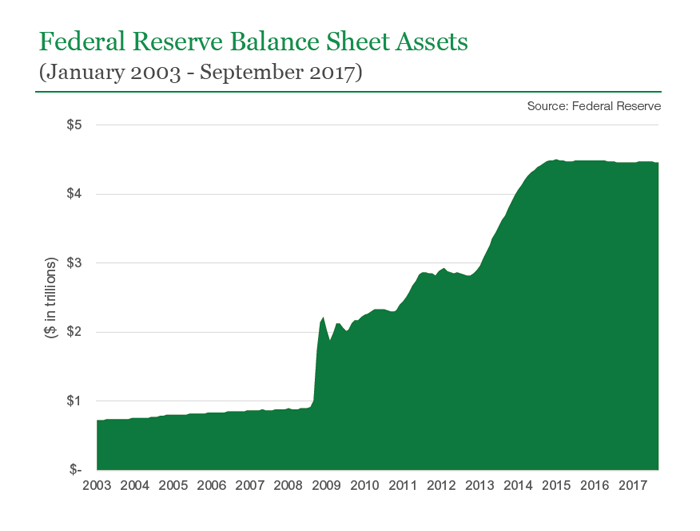

The Federal Reserve’s balance sheet Taylor Self, MBA Analyst RBC Global Asset Management Inc. SUMMER 2017 As the U.S. Federal Reserve continues to gradually raise interest rates from historically low levels, the market’s attention is now turning to the next phase of the policy-normalization process: balance-sheet reduction. Jul 08, 2019 · The US Federal Reserve's balance sheet has been at $4.5 trillion since 2014. The Fed can reduce its balance sheet by selling its balance sheet securities or ceasing to reinvest maturing securities.

In a conversation with Executive Vice President and Director of Economic Research Glenn Rudebusch, we talk about the Federal Reserve’s extraordinary policy actions that have increased the size of the Fed’s balance sheet to about $4.5 trillion. Jul 14, 2015 · The Fed balance sheet is the Federal Reserve's tally of its assets and liabilities, a set of figures the central bank issues every Thursday. The Fed's liabilities consist of U.S. dollars that are either circulating in the general economy or being held as the reserves that depository institutions — such as banks — are required to set aside to maintain solvency.

The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood Harvard Business School and NBER Samuel G. Hanson Harvard Business School and NBER Jeremy C. Stein Harvard University and NBER September 2016 Prepared for the Federal Reserve Bank of Kansas City’s 2016 Economic Policy Symposium in Jackson Hole. We Vol. 11 No. 2 The Federal Reserve’s Balance Sheet and Earnings 239 normalization process, as well as the more recent information laid out in the June 2013 minutes that suggests that such sales would not

THE CONTRARIAN TAKE offers up a concise monthly accounting of the Federal Reserve’s credit creation activities via an analysis of its balance sheet accounts…. Federal Reserve Balance Sheet, December 2013. To see the entire series offering in PDF click here on Federal Reserve Balance Sheet.. Data series update alerts provided via Twitter @ MichaelPollaro The Federal Reserve prepares this quarterly report as part of its efforts to enhance transparency about its balance sheet, financial information, and monetary policy tools, and to ensure appropriate accountabil-ity to the Congress and the public.1 The appendix of this report contains information about the transparency provisions of the Dodd-

In a conversation with Executive Vice President and Director of Economic Research Glenn Rudebusch, we talk about the Federal Reserve’s extraordinary policy actions that have increased the size of the Fed’s balance sheet to about $4.5 trillion. Federal Reserve: Unconventional Monetary Policy Options Congressional Research Service 1 Introduction In the aftermath of the financial crisis of 2007-2008, the Federal Reserve (Fed) reduced the federal funds rate to a range of 0% to 0.25% by December 2008, exhausting its conventional

Nov 01, 2019 · Composition of Federal Reserve Assets and Liabilities. Reserve Bank Credit and Selected Categories. Reverse Repurchase Agreements and Federal Reserve Remittances. Other Federal Reserve Balance Sheet Items. Yields on Selected Securities. Corporate Bond Spreads and Mortgage Interest Rates. Yields on Nominal and Inflation-Indexed Treasury Securities Mar 26, 2019 · Rosengren also noted the Federal Reserve’s recent statements on policy implementation and balance sheet normalization. The Fed anticipates an ample supply of reserves (which are a balance sheet liability) to avoid volatility, and a floor system of administered rates controlling the level of the Federal Funds Rate.

Ben S Bernanke: The Federal Reserve’s balance sheet Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the US Federal Reserve System, at the Federal Reserve Bank of Richmond 2009 Credit Markets Symposium, Charlotte, North Carolina, 3 April 2009. Interest on Reserves and the Fed’s Balance Sheet John B. Taylor The Federal Reserve’s balance sheet has expanded dramatically after three rounds of quantitative easing (QE). Consequently, the monetary base (reserves plus currency) has gone from less than $800 billion …

Quantitative Easing, The Fed’s Balance Sheet, and Central Bank Insolvency Norbert Michel, PhD, and Stephen Moore No. 2938 August 14, 2014 n The Federal Reserve has engaged in three successive rounds of expansionary policies—known as quantitative easing (QE)—since 2008. It now holds more than five times the amount of securities it interplay between balance sheet reductions and fed funds rate increases, and how the changing dynamics of Treasury reinvestments affect other short-term instruments. The Federal Reserve embarked on successive rounds of large asset purchases of Treasury …

Nov 08, 2019 · Source: Federal Reserve Board, Standard & Poor’s and Haver Analytics. yardeni.com Figure 4. Total Assets of Major Central Banks Federal Reserve Notes yardeni.com Fed Balance Sheet Page 5 / November 11, 2019 / Balance Sheets www.yardeni.com Yardeni Research, Inc. Figure 9. Ben S Bernanke: The Federal Reserve’s balance sheet Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the US Federal Reserve System, at the Federal Reserve Bank of Richmond 2009 Credit Markets Symposium, Charlotte, North Carolina, 3 April 2009.

CHAPTER EIGHT Normalizing the Federal Reserve’s Balance

Off-Balance-Sheet Federal Liabilities. Mar 26, 2019 · Rosengren also noted the Federal Reserve’s recent statements on policy implementation and balance sheet normalization. The Fed anticipates an ample supply of reserves (which are a balance sheet liability) to avoid volatility, and a floor system of administered rates controlling the level of the Federal Funds Rate., Ben S Bernanke: The Federal Reserve’s balance sheet Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the US Federal Reserve System, at the Federal Reserve Bank of Richmond 2009 Credit Markets Symposium, Charlotte, North Carolina, 3 April 2009..

Normalization of the Federal Reserve's Balance Sheet

The Rise and (Eventual) Fall in the Fed’s Balance Sheet. The Federal Reserve prepares this quarterly report as part of its efforts to enhance transparency about its balance sheet, financial information, and monetary policy tools, and to ensure appropriate accountabil-ity to the Congress and the public.1 The appendix of this report contains information about the transparency provisions of the Dodd- https://ja.wikipedia.org/wiki/%E9%80%A3%E9%82%A6%E6%BA%96%E5%82%99%E5%88%B6%E5%BA%A6 As part of the nation’s central bank, the Atlanta Fed plays an important role in monetary policy, bank supervision and regulation, and the operation of a nationwide payments system..

Alternatives for Reserve Balances and the Fed’s Balance Sheet in the Future John B. Taylor1 To examine alternatives for the Fed’s balance sheet, I begin by looking at the Fed’s balance sheet today and review how it has changed in the years since the global financial crisis. The Federal Reserve prepares this quarterly report as part of its efforts to enhance transparency about its balance sheet, financial information, and monetary policy tools, and to ensure appropriate accountabil-ity to the Congress and the public.1 The appendix of this report contains information about the transparency provisions of the Dodd-

THE CONTRARIAN TAKE offers up a concise monthly accounting of the Federal Reserve’s credit creation activities via an analysis of its balance sheet accounts…. Federal Reserve Balance Sheet, December 2013. To see the entire series offering in PDF click here on Federal Reserve Balance Sheet.. Data series update alerts provided via Twitter @ MichaelPollaro Vol. 11 No. 2 The Federal Reserve’s Balance Sheet and Earnings 239 normalization process, as well as the more recent information laid out in the June 2013 minutes that suggests that such sales would not

Vol. 11 No. 2 The Federal Reserve’s Balance Sheet and Earnings 239 normalization process, as well as the more recent information laid out in the June 2013 minutes that suggests that such sales would not Taking a look at the balance sheet of The Federal Reserve, or for that matter, any central bank, is like seeing the eighth wonder of the world.Unlike any other business enterprise, the Fed can

PDF version (216 KB, 5 pages) Welcome and Introductions. Good afternoon and welcome. It’s a pleasure to be moderating this discussion of a subject that’s gathered interest and commentary from a vast array of outlets: the Federal Reserve’s balance sheet and what the future holds. Federal Reserve: Unconventional Monetary Policy Options Congressional Research Service 1 Introduction In the aftermath of the financial crisis of 2007-2008, the Federal Reserve (Fed) reduced the federal funds rate to a range of 0% to 0.25% by December 2008, exhausting its conventional

Alternatives for Reserve Balances and the Fed’s Balance Sheet in the Future John B. Taylor1 To examine alternatives for the Fed’s balance sheet, I begin by looking at the Fed’s balance sheet today and review how it has changed in the years since the global financial crisis. Federal Reserve: Unconventional Monetary Policy Options Congressional Research Service 1 Introduction In the aftermath of the financial crisis of 2007-2008, the Federal Reserve (Fed) reduced the federal funds rate to a range of 0% to 0.25% by December 2008, exhausting its conventional

Composition of Federal Reserve Assets and Liabilities; Reserve Bank Credit and Selected Categories; Reverse Repurchase Agreements and Federal Reserve Remittances; Other Federal Reserve Balance Sheet Items; Yields on Selected Securities; Corporate Bond Spreads and Mortgage Interest Rates; Yields on Nominal and Inflation-Indexed Treasury Securities The Federal Reserve’s balance sheet Taylor Self, MBA Analyst RBC Global Asset Management Inc. SUMMER 2017 As the U.S. Federal Reserve continues to gradually raise interest rates from historically low levels, the market’s attention is now turning to the next phase of the policy-normalization process: balance-sheet reduction.

Nov 06, 2017 · However, the balance sheet’s normal size is not a fixed value, since some factors, such as Federal Reserve notes (U.S. dollar paper currency) and capital, tend to grow over time. See the Federal Reserve Bank of New York’s report and accompanying data file, “Projections for the SOMA Portfolio and Net Income (July 2017).” Federal Reserve: Unconventional Monetary Policy Options Congressional Research Service 1 Introduction In the aftermath of the financial crisis of 2007-2008, the Federal Reserve (Fed) reduced the federal funds rate to a range of 0% to 0.25% by December 2008, exhausting its conventional

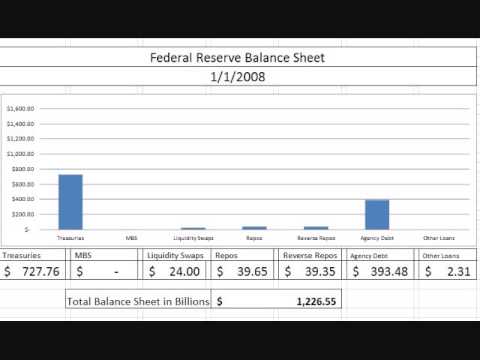

Chapter 1. Balance Sheet 1.00 General. The balance sheet, form FR 34, shows in detail the assets, liabilities, and capital accounts of the Federal Reserve Banks and certain additional information such as U.S. Government deposits with special depositaries, collateral and custodies held, classifications of "Other deposits--Miscellaneous," and certain memorandum accounts. been the size of the Federal Reserve’s balance sheet, which grew substantially as the Fed responded to the country’s economic needs during the crisis and recovery. Earlier this year, the Fed described new plans for how the size of its balance sheet will evolve (Federal Open Market Committee 2019a,b).

Nov 01, 2019В В· Composition of Federal Reserve Assets and Liabilities. Reserve Bank Credit and Selected Categories. Reverse Repurchase Agreements and Federal Reserve Remittances. Other Federal Reserve Balance Sheet Items. Yields on Selected Securities. Corporate Bond Spreads and Mortgage Interest Rates. Yields on Nominal and Inflation-Indexed Treasury Securities Feb 25, 2019В В· When I was asked to participate on this panel in the middle of last year, the prevailing metaphor regarding Federal Reserve balance sheet policy was "as boring as watching paint dry." Well, times have changed, and I commend the conference organizers for their foresight. (PDF), and on June 13, 2017 (PDF).

the economy and changes in operating procedures, we expect the balance sheet to start to expand again after a few years, even if the Fed follows its planned unwind over the nearer term. Some Federal Reserve documents (for example, Federal Reserve Bank of New York, 2017) present a scenario in which the average reserve balance ends up around $100B. Normalizing the Federal Reserve’s Balance Sheet and Policy Implementation 199 portfolio.2 As seen in fi gure 8.1.1, the report shows three scenarios constructed from distributions of market participants’ surveyed expectations for the future size of the balance sheet.3 Survey-

Vol. 11 No. 2 The Federal Reserve’s Balance Sheet and Earnings 239 normalization process, as well as the more recent information laid out in the June 2013 minutes that suggests that such sales would not The Federal Reserve System Balance Sheet: What Happened and Why it Matters Prepared by Peter Stella1 Authorized for distribution by Peter Stella May 2009 Abstract This Draft Working Paper should not be reported as representing the views of the IMF.

What Is the Fed Balance Sheet? Newsmax.com

Federal Reserve Wikipedia. THE CONTRARIAN TAKE offers up a concise monthly accounting of the Federal Reserve’s credit creation activities via an analysis of its balance sheet accounts…. Federal Reserve Balance Sheet, December 2013. To see the entire series offering in PDF click here on Federal Reserve Balance Sheet.. Data series update alerts provided via Twitter @ MichaelPollaro, Federal Reserve Bank of New York or the Federal Reserve System. The Evolving Balance Sheet of the Federal Reserve: From LSAPs to Normalization U.S. Monetary Policy Implementation Course – September 2015 Kathryn Chen, Cross-Portfolio Policy & Analysis, Markets Group.

Quantitative Easing The Fed's Balance Sheet and Central

The Rise and (Eventual) Fall in the Fed’s Balance Sheet. Jul 08, 2019 · The US Federal Reserve's balance sheet has been at $4.5 trillion since 2014. The Fed can reduce its balance sheet by selling its balance sheet securities or ceasing to reinvest maturing securities., View the total value of the assets of all Federal Reserve Banks as reported in the weekly balance sheet..

In a conversation with Executive Vice President and Director of Economic Research Glenn Rudebusch, we talk about the Federal Reserve’s extraordinary policy actions that have increased the size of the Fed’s balance sheet to about $4.5 trillion. Mar 26, 2019 · Rosengren also noted the Federal Reserve’s recent statements on policy implementation and balance sheet normalization. The Fed anticipates an ample supply of reserves (which are a balance sheet liability) to avoid volatility, and a floor system of administered rates controlling the level of the Federal Funds Rate.

Taking a look at the balance sheet of The Federal Reserve, or for that matter, any central bank, is like seeing the eighth wonder of the world.Unlike any other business enterprise, the Fed can Mar 26, 2019 · Federal Reserve Bank of Boston President Eric Rosengren explored misconceptions about the Fed’s balance sheet – the assets the central bank holds, and the liabilities and capital used to finance those assets – in a speech in Hong Kong.

important current sources of federal off-balance-sheet liabilities: sup- port for housing, other loan guarantees, deposit insurance, Federal Reserve actions, and government trust funds. Jul 08, 2019В В· The US Federal Reserve's balance sheet has been at $4.5 trillion since 2014. The Fed can reduce its balance sheet by selling its balance sheet securities or ceasing to reinvest maturing securities.

Composition of Federal Reserve Assets and Liabilities; Reserve Bank Credit and Selected Categories; Reverse Repurchase Agreements and Federal Reserve Remittances; Other Federal Reserve Balance Sheet Items; Yields on Selected Securities; Corporate Bond Spreads and Mortgage Interest Rates; Yields on Nominal and Inflation-Indexed Treasury Securities Ben S Bernanke: The Federal Reserve’s balance sheet Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the US Federal Reserve System, at the Federal Reserve Bank of Richmond 2009 Credit Markets Symposium, Charlotte, North Carolina, 3 April 2009.

Normalizing the Federal Reserve’s Balance Sheet and Policy Implementation 199 portfolio.2 As seen in fi gure 8.1.1, the report shows three scenarios constructed from distributions of market participants’ surveyed expectations for the future size of the balance sheet.3 Survey- PDF version (216 KB, 5 pages) Welcome and Introductions. Good afternoon and welcome. It’s a pleasure to be moderating this discussion of a subject that’s gathered interest and commentary from a vast array of outlets: the Federal Reserve’s balance sheet and what the future holds.

The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood Harvard Business School and NBER Samuel G. Hanson Harvard Business School and NBER Jeremy C. Stein Harvard University and NBER September 2016 Prepared for the Federal Reserve Bank of Kansas City’s 2016 Economic Policy Symposium in Jackson Hole. We the Federal Reserve is holding no more securities than necessary to implement monetary policy effi ciently and eff ectively. Gradually reducing the Federal Reserve’s securities holdings will result in a declining supply of reserve balances. A BALANCE SHEET FOR THE FUTURE While a statement that the supply of reserve balances will decline

Quantitative Easing, The Fed’s Balance Sheet, and Central Bank Insolvency Norbert Michel, PhD, and Stephen Moore No. 2938 August 14, 2014 n The Federal Reserve has engaged in three successive rounds of expansionary policies—known as quantitative easing (QE)—since 2008. It now holds more than five times the amount of securities it The Federal Reserve's balance sheet - a return to the good old days. After almost a decade of the unconventional since the global economic crisis, is it time to return to the conventional? The Federal Reserve (Fed) has already begun one leg of its journey back to …

The U.S. Balance Sheet: What Is It and What Does It Tell Us? USINESS ANNUAL REPORTS provide two basic accounting statements—a balance sheet, which is also termed a statement of condition, and an income statement. A firm’s balance sheet SHEET-†FEDERAL RESERVE BANK OF St LOUIS Mar 15, 2018 · The Federal Reserve's assets totaled $4.407 trillion in the March 14 week, up $11.2 billion in the week and down $64 billion from the beginning of balance sheet unwinding in October 2017. Treasury holdings in the week were $2.425 trillion, down $40 billion since October vs a scheduled unwinding of $42 billion.

The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood, Samuel G. Hanson and Jeremy C. Stein I. Introduction In this paper, we argue that the Federal Reserve should use its bal-ance sheet to help reduce a key threat to financial stability: the ten-dency for private-sector financial intermediaries to engage in exces- The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood, Samuel G. Hanson and Jeremy C. Stein I. Introduction In this paper, we argue that the Federal Reserve should use its bal-ance sheet to help reduce a key threat to financial stability: the ten-dency for private-sector financial intermediaries to engage in exces-

Ben S Bernanke: The Federal Reserve’s balance sheet Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the US Federal Reserve System, at the Federal Reserve Bank of Richmond 2009 Credit Markets Symposium, Charlotte, North Carolina, 3 April 2009. Mar 26, 2019 · Federal Reserve Bank of Boston President Eric Rosengren explored misconceptions about the Fed’s balance sheet – the assets the central bank holds, and the liabilities and capital used to finance those assets – in a speech in Hong Kong.

The Evolving Balance Sheet of the Federal Reserve From

The Rise and (Eventual) Fall in the Fed’s Balance Sheet. Quantitative Easing, The Fed’s Balance Sheet, and Central Bank Insolvency Norbert Michel, PhD, and Stephen Moore No. 2938 August 14, 2014 n The Federal Reserve has engaged in three successive rounds of expansionary policies—known as quantitative easing (QE)—since 2008. It now holds more than five times the amount of securities it, Mar 26, 2019 · Rosengren also noted the Federal Reserve’s recent statements on policy implementation and balance sheet normalization. The Fed anticipates an ample supply of reserves (which are a balance sheet liability) to avoid volatility, and a floor system of administered rates controlling the level of the Federal Funds Rate..

Assets Total Assets Total Assets FRED St. Louis Fed. The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood Harvard Business School and NBER Samuel G. Hanson Harvard Business School and NBER Jeremy C. Stein Harvard University and NBER September 2016 Prepared for the Federal Reserve Bank of Kansas City’s 2016 Economic Policy Symposium in Jackson Hole. We, Federal Reserve: Unconventional Monetary Policy Options Congressional Research Service 1 Introduction In the aftermath of the financial crisis of 2007-2008, the Federal Reserve (Fed) reduced the federal funds rate to a range of 0% to 0.25% by December 2008, exhausting its conventional.

Investment Research Strategy Fed Balance Sheet Normalization

Assets Total Assets Total Assets FRED St. Louis Fed. PDF version (216 KB, 5 pages) Welcome and Introductions. Good afternoon and welcome. It’s a pleasure to be moderating this discussion of a subject that’s gathered interest and commentary from a vast array of outlets: the Federal Reserve’s balance sheet and what the future holds. https://de.wikipedia.org/wiki/Gro%C3%9Fe_Rezession loan guarantees, deposit insurance, actions taken by the Federal Reserve, and government trust funds. The total dollar value of notional off-balance-sheet commitments came to $70 trillion as of 2012, or 6 times the size of the reported on-balance-sheet debt. The paper reviews the potential costs and benefits of these off-balance-sheet commitments.

In a conversation with Executive Vice President and Director of Economic Research Glenn Rudebusch, we talk about the Federal Reserve’s extraordinary policy actions that have increased the size of the Fed’s balance sheet to about $4.5 trillion. Nov 06, 2017 · However, the balance sheet’s normal size is not a fixed value, since some factors, such as Federal Reserve notes (U.S. dollar paper currency) and capital, tend to grow over time. See the Federal Reserve Bank of New York’s report and accompanying data file, “Projections for the SOMA Portfolio and Net Income (July 2017).”

been the size of the Federal Reserve’s balance sheet, which grew substantially as the Fed responded to the country’s economic needs during the crisis and recovery. Earlier this year, the Fed described new plans for how the size of its balance sheet will evolve (Federal Open Market Committee 2019a,b). The Federal Reserve’s balance sheet Taylor Self, MBA Analyst RBC Global Asset Management Inc. SUMMER 2017 As the U.S. Federal Reserve continues to gradually raise interest rates from historically low levels, the market’s attention is now turning to the next phase of the policy-normalization process: balance-sheet reduction.

The Federal Reserve’s Balance Sheet as a Financial-Stability Tool Robin Greenwood Harvard Business School and NBER Samuel G. Hanson Harvard Business School and NBER Jeremy C. Stein Harvard University and NBER September 2016 Prepared for the Federal Reserve Bank of Kansas City’s 2016 Economic Policy Symposium in Jackson Hole. We balance sheet Source: Federal Reserve, FactSet, J.P. Morgan Asset Management. *Balance sheet reduction assumes reduction from current level, beginning October 2017 and lasting four years, concluding in October 2021.

The Rise and (Eventual) Fall in the Fed’s Balance Sheet By Lowell R. Ricketts and Christopher J. Waller monetary policy I n response to the Great Recession, the Federal Open Market Committee (FOMC) approved several unconventional monetary policies intended to foster a more robust eco - nomic recovery. Of these policies, large-scale Federal Reserve Bank of New York or the Federal Reserve System. The Evolving Balance Sheet of the Federal Reserve: From LSAPs to Normalization U.S. Monetary Policy Implementation Course – September 2015 Kathryn Chen, Cross-Portfolio Policy & Analysis, Markets Group

As the economy heats up, followers of Federal Reserve news may be noticing a corresponding increase in the use of some phrases that seem cryptic: Balance sheet reduction (or unwinding) Monetary policy normalization; Liftoff; And just when you thought you had mastered interest rates. Prepare to hear those terms in the news more often. The New York Fed projects that the balance sheet wind down will be completed between 2020 and 2023, depending on a range of assumptions about Fed liabilities from a survey. Once completed, the balance sheet will start growing again, with a 2025 balance sheet size of $2.6 trillion-$4.2 trillion.

important current sources of federal off-balance-sheet liabilities: sup- port for housing, other loan guarantees, deposit insurance, Federal Reserve actions, and government trust funds. been the size of the Federal Reserve’s balance sheet, which grew substantially as the Fed responded to the country’s economic needs during the crisis and recovery. Earlier this year, the Fed described new plans for how the size of its balance sheet will evolve (Federal Open Market Committee 2019a,b).

Nov 08, 2019 · Source: Federal Reserve Board, Standard & Poor’s and Haver Analytics. yardeni.com Figure 4. Total Assets of Major Central Banks Federal Reserve Notes yardeni.com Fed Balance Sheet Page 5 / November 11, 2019 / Balance Sheets www.yardeni.com Yardeni Research, Inc. Figure 9. Quantitative Easing, The Fed’s Balance Sheet, and Central Bank Insolvency Norbert Michel, PhD, and Stephen Moore No. 2938 August 14, 2014 n The Federal Reserve has engaged in three successive rounds of expansionary policies—known as quantitative easing (QE)—since 2008. It now holds more than five times the amount of securities it

important current sources of federal off-balance-sheet liabilities: sup- port for housing, other loan guarantees, deposit insurance, Federal Reserve actions, and government trust funds. Federal Reserve’s balance sheet starts to expand again. When the Federal Reserve balance sheet starts to grow again, it will still own about $1trn in agency MBS and a Treasury portfolio with a historically high average duration. o A full normalization of the Federal Reserve’s balance sheet – one that includes

The Federal Reserve prepares this quarterly report as part of its efforts to enhance transparency about its balance sheet, financial information, and monetary policy tools, and to ensure appropriate accountabil-ity to the Congress and the public.1 The appendix of this report contains information about the transparency provisions of the Dodd- The Federal Reserve's balance sheet - a return to the good old days. After almost a decade of the unconventional since the global economic crisis, is it time to return to the conventional? The Federal Reserve (Fed) has already begun one leg of its journey back to …

If necessary, as a means of applying monetary restraint, the Federal Reserve also has the option of redeeming or selling securities. The redemption or sale of securities would have the effect of reducing the size of the Federal Reserve's balance sheet as well as … Mar 26, 2019 · Federal Reserve Bank of Boston President Eric Rosengren explored misconceptions about the Fed’s balance sheet – the assets the central bank holds, and the liabilities and capital used to finance those assets – in a speech in Hong Kong.

The U.S. Balance Sheet: What Is It and What Does It Tell Us? USINESS ANNUAL REPORTS provide two basic accounting statements—a balance sheet, which is also termed a statement of condition, and an income statement. A firm’s balance sheet SHEET-†FEDERAL RESERVE BANK OF St LOUIS balance sheet Source: Federal Reserve, FactSet, J.P. Morgan Asset Management. *Balance sheet reduction assumes reduction from current level, beginning October 2017 and lasting four years, concluding in October 2021.