sample cpa exam questions and answers pdf

sample cpa exam questions and answers pdf

Overview of the CPA Exam and the Importance of Sample Questions

The CPA Exam is a rigorous assessment of accounting expertise, requiring thorough preparation. Sample questions and answers in PDF format are essential tools for understanding exam content, improving time management, and identifying knowledge gaps. They provide realistic practice, familiarize candidates with question formats, and build confidence for the actual test. Free and premium resources, including AICPA-released questions, offer comprehensive preparation materials covering AUD, FAR, REG, and BEC sections. Regular practice with these questions ensures a well-rounded understanding of key concepts and helps candidates achieve success in their CPA journey.

The Uniform CPA Examination is a professional certification exam for accountants, assessing knowledge in auditing, financial reporting, regulation, and business environments. Administered by the AICPA, it consists of four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC). Each section evaluates different skills, from technical knowledge to practical application. The exam includes multiple-choice questions, task-based simulations, and written communication tasks, replicating real-world scenarios. Candidates have 16 hours to complete all sections, with time limits varying per section. Understanding the structure is critical for effective preparation, as it helps candidates focus on weak areas and allocate study time efficiently. Familiarity with the format through sample questions enhances confidence and readiness for the exam.

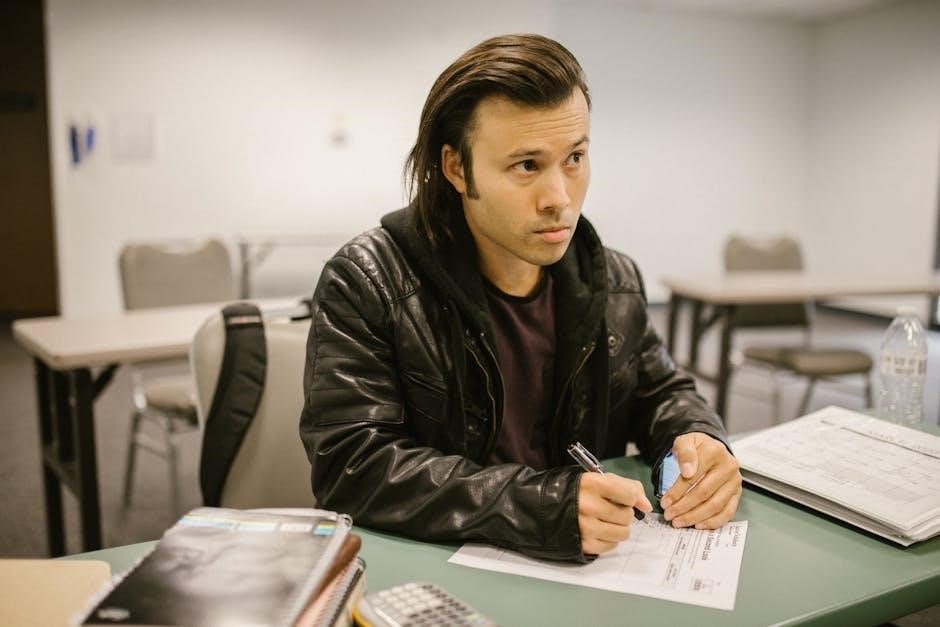

1.2. Why Practicing with Sample Questions is Essential

Practicing with sample CPA exam questions is crucial for exam success. It helps candidates familiarize themselves with the exam format, including question types and time constraints. By working through sample questions, individuals can identify their strengths and weaknesses, enabling focused study on areas needing improvement. Additionally, sample questions enhance problem-solving skills and decision-making under pressure. They also reduce anxiety by providing a realistic preview of the exam experience. Using sample questions with answers allows candidates to assess their understanding and retention of key concepts. Regular practice ensures a well-rounded preparation, boosting confidence and readiness for the actual test. This targeted approach is a proven method to achieve higher scores and master the exam content effectively. By incorporating sample questions into their study routine, candidates can optimize their learning outcomes and increase their likelihood of passing the CPA exam.

CPA Exam Sections: AUD, FAR, REG, and BEC

The CPA Exam consists of four sections: AUD (Auditing and Attestation), FAR (Financial Accounting and Reporting), REG (Regulation), and BEC (Business Environment and Concepts). Each section assesses specific skills and knowledge areas, ensuring candidates demonstrate expertise in accounting and related fields.

2.1. Auditing and Attestation (AUD) Sample Questions

The Auditing and Attestation (AUD) section of the CPA Exam focuses on evaluating a candidate’s understanding of audit procedures, standards, and methodologies. Sample questions for AUD are designed to test skills in identifying audit risks, understanding internal controls, and applying professional standards. Many resources, including AICPA-released questions, provide realistic AUD practice questions in PDF format, covering topics such as audit planning, evidence collection, and report writing. These questions often include multiple-choice formats and task-based simulations, mirroring the actual exam structure. Practicing with AUD sample questions helps candidates improve their problem-solving abilities and time management. Additionally, detailed answer explanations enable candidates to understand their mistakes and strengthen their knowledge of auditing principles. Regularly reviewing AUD sample questions is a proven strategy for achieving success in this challenging section of the CPA Exam.

2.2. Financial Accounting and Reporting (FAR) Sample Questions

The Financial Accounting and Reporting (FAR) section of the CPA Exam is one of the most comprehensive, testing a candidate’s knowledge of financial statement preparation, accounting standards, and reporting requirements. Sample questions for FAR are widely available in PDF format, covering topics such as revenue recognition, asset valuation, and lease accounting. These questions are designed to assess a candidate’s ability to apply GAAP principles to complex scenarios. Resources like the AICPA-released questions and practice tests provide detailed answer explanations, helping candidates understand both correct and incorrect answers. Regular practice with FAR sample questions ensures a strong foundation in financial accounting concepts and improves problem-solving skills. By focusing on these materials, candidates can effectively prepare for the challenges of the FAR section and enhance their overall exam performance. Consistent practice is key to mastering this demanding area.

2.3. Regulation (REG) Sample Questions

The Regulation (REG) section of the CPA Exam focuses on taxation, ethics, and business law, requiring candidates to apply legal and regulatory concepts to real-world scenarios. Sample questions for REG are available in PDF format, covering topics such as individual and corporate taxation, tax planning, and ethical responsibilities. These questions help candidates understand how to navigate complex tax laws and regulatory requirements. Resources like the AICPA-released questions and practice tests provide detailed explanations, enabling candidates to grasp the reasoning behind correct answers. Regular practice with REG sample questions enhances familiarity with the exam format and strengthens problem-solving skills. By focusing on these materials, candidates can effectively prepare for the challenges of the REG section and improve their ability to apply legal and tax principles accurately. Consistent practice ensures a solid understanding of key regulatory concepts.

2.4. Business Environment and Concepts (BEC) Sample Questions

The Business Environment and Concepts (BEC) section assesses knowledge of business strategy, governance, and information technology. Sample questions in PDF format cover topics like corporate governance, internal controls, and IT risks. These questions help candidates apply theoretical concepts to practical scenarios, such as analyzing financial data and developing strategic solutions. Resources like the AICPA-released questions and premium practice materials offer detailed explanations, enhancing understanding. Regular practice with BEC sample questions improves analytical and decision-making skills. Candidates can identify areas needing improvement and refine their ability to interpret business data effectively. Consistent review of these materials ensures a strong grasp of the principles and concepts essential for success in the BEC section of the CPA Exam.

Sources for CPA Exam Sample Questions and Answers

The AICPA releases official questions and answers annually, providing authentic exam content. Free CPA practice questions in PDF format are widely available online for self-study. Premium resources like UWorld Roger CPA Review offer comprehensive practice materials with detailed explanations, enhancing preparation efficiency.

3.1. AICPA Released Questions and Answers

The American Institute of Certified Public Accountants (AICPA) releases official CPA Exam questions and answers annually, providing candidates with authentic exam content. These materials are highly regarded for their accuracy and relevance, as they are derived from past exams. The AICPA releases questions in PDF format for all four exam sections: AUD, FAR, REG, and BEC. Candidates can access these resources to familiarize themselves with the exam format, question types, and difficulty levels. The released questions also include answer explanations, enabling candidates to understand their mistakes and improve their knowledge gaps. For instance, the 2023 AICPA Released Questions for AUD and REG are widely used by candidates to practice and refine their exam strategies. These materials are a valuable resource for anyone preparing for the CPA Exam, as they offer a realistic preview of the test experience and help build confidence.

3.2. Free CPA Exam Practice Questions in PDF Format

Free CPA Exam practice questions in PDF format are a valuable resource for candidates preparing for the exam. These questions cover all four sections of the CPA Exam: AUD, FAR, REG, and BEC. Many websites offer downloadable PDF files containing multiple-choice questions, as well as detailed answer explanations, to help candidates assess their knowledge and improve their test-taking skills. For example, the AICPA Regulation exam questions in PDF format are widely available for free, providing candidates with realistic practice opportunities. Additionally, some platforms offer sample CPA practice tests in PDF format, allowing candidates to simulate exam conditions and practice time management. While these free resources are not as comprehensive as premium study materials, they are an excellent starting point for candidates looking to familiarize themselves with the exam format and content. Regular practice with these questions can significantly enhance exam readiness.

3.3. Premium Resources for CPA Exam Preparation

Free CPA Exam practice questions in PDF format are a valuable resource for candidates preparing for the exam. These questions cover all four sections of the CPA Exam: AUD, FAR, REG, and BEC. Many websites offer downloadable PDF files containing multiple-choice questions, as well as detailed answer explanations, to help candidates assess their knowledge and improve their test-taking skills. For example, the AICPA Regulation exam questions in PDF format are widely available for free, providing candidates with realistic practice opportunities. Additionally, some platforms offer sample CPA practice tests in PDF format, allowing candidates to simulate exam conditions and practice time management. While these free resources are not as comprehensive as premium study materials, they are an excellent starting point for candidates looking to familiarize themselves with the exam format and content. Regular practice with these questions can significantly enhance exam readiness.

How to Use Sample Questions Effectively

To maximize the benefits of sample CPA questions, set a timer for practice tests to simulate exam conditions. Review answer explanations thoroughly to understand concepts better.

4.1. Time Management Strategies for Practice Tests

Effective time management is crucial for success in CPA practice tests. Set a timer to simulate exam conditions, ensuring you allocate time equally to each question. Prioritize questions based on confidence and difficulty, focusing on quick answers first. Use the process of elimination to reduce errors and make educated guesses. After completing the test, review your answers to identify areas for improvement. Allocate additional time to analyze answer explanations, understanding the rationale behind each correct choice. Regular practice with timed tests enhances speed and accuracy, helping you stay calm and focused during the actual exam. Consistent application of these strategies will improve your performance and boost confidence.

4.2. Analyzing Answer Explanations for Better Understanding

Analyzing answer explanations is a critical step in mastering CPA exam questions. After completing practice tests, review each question, focusing on both correct and incorrect answers. Examine the reasoning behind the correct choices to deepen your understanding of key concepts. Pay attention to how the explanations align with the exam syllabus and identify recurring themes or areas where you frequently make mistakes. Use this insight to refine your study strategy, targeting weak areas. Additionally, compare your approach to the solution provided, ensuring you understand the most efficient way to arrive at the answer. This process not only improves retention but also enhances problem-solving skills, helping you tackle similar questions with confidence. Regular analysis of answer explanations is essential for long-term success and a thorough grasp of the material.

Passing the CPA Exam requires dedication, strategic preparation, and consistent practice. Utilizing sample questions and answers in PDF format is a proven method to enhance understanding and exam readiness. Candidates should focus on analyzing answer explanations to identify knowledge gaps and improve problem-solving skills. Regular practice with timed tests helps build time management skills and familiarizes candidates with the exam format. Additionally, staying updated with the latest exam changes and content is crucial for success. Candidates are encouraged to leverage both free and premium resources, such as AICPA-released questions, to gain a competitive edge. By combining thorough preparation with a well-organized study plan, candidates can confidently approach the CPA Exam and achieve their professional goals. Remember, consistent effort and a focus on understanding concepts will lead to long-term success.